Unveiling the all Powerful UPI Observability Platform from VuNet

- Jul 3, 2023

- Blogs

- 5 min read

In the rapidly evolving digital banking landscape, UPI applications have emerged as the preferred mode of payment for millions of customers across India. However, with this increasing dependence on UPI, banks also face the challenge of maintaining the system’s reliability and performance.

Technical declines and high response times have become two significant hurdles for banks to overcome, leading to unsatisfied customers and damaging brand reputation. Moreover, compliance is critical for any business that deals with UPI transactions. Failing to meet UPI guidelines can result in penalties and loss of customer trust.

Technical declines, caused by application errors, network connectivity issues, or other problems, can result in failed transactions, frustrating customers, and leading to potential revenue losses. Similarly, high response times can significantly impact the user experience, causing customers to abandon transactions and leading to lost opportunities for banks.

In today’s hyper-connected world, customers expect seamless and frictionless experiences while transacting online, and banks that fail to provide these experiences risk falling behind their competitors. Therefore, it is critical for banks to address these issues proactively and ensure that their UPI applications are delivering optimal performance and reliability. This is where the all new UPI Observability ExperienceCenter by VuNet Systems comes in.

VuNet Systems, based out of Bengaluru, has developed a fully indigenous AI-driven Business Journey Observability platform that is currently powering observability at some of India’s Top 10 banks.

VuNet’s cutting-edge UPI Observability Platform has successfully reduced Technical Declines by over 50% for our Banking, Payment gateway, and Fintech clients. Our clients, on average, have achieved a 400%+ ROI on their investment in our platform, resulting in increased revenue, decreased operational expenses, and reduced customer churn.

By providing deeper insights into application behavior, smooth integration, and programmable real-time alerts,and probable RCA, our platform can help banks detect and resolve anomalous behavior caused by technical declines and slower response times, ensuring an exceptional customer experience.

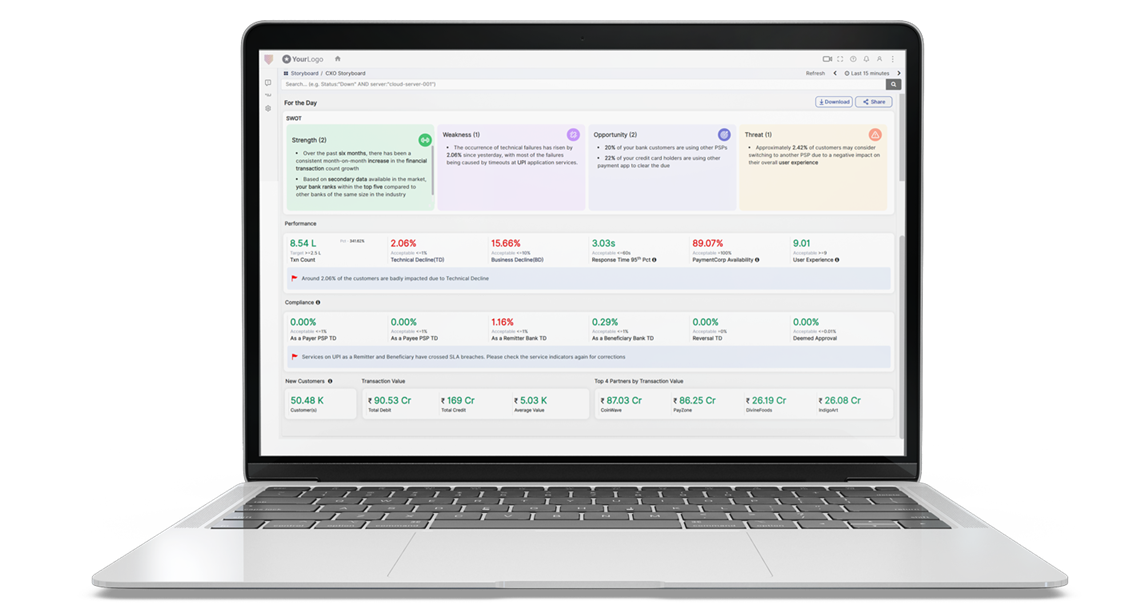

The CXO Storyboard offered by us can help banks closely monitor Technical Declines of their UPI payment system for both financial and non-financial transactions, leading to an improvement in their ranking and brand image. It is recommended that Technical and Business Declines should be less than 1% for financial transactions and less than 10% for non-financial transactions. Additionally, as a Remitter Bank, the success rate for Debit Reversal should be 100%, and as a Beneficiary Bank, the Deemed Approval rate should be less than 0.01%. If any of these metrics fall outside the acceptable range, we can promptly take appropriate action to ensure compliance with the guidelines and maintain a better ranking for your bank.

In addition to resolving these issues, our platform helps identify revenue opportunities. We provide a list of customers who are using other payment service providers and partners that offer higher value. This enables your business owners to encourage these customers to switch to your PSP by offering discounts. Our platform also identifies the top-performing partners, allowing you to provide additional discounts to these merchants and attract more transaction value to your bank.

Our ITOps Storyboard quickly helps identify the specific touchpoint responsible for technical issues, allowing for prompt and corrective action to be taken. The User Experience Index (UEI) score, rated on a scale of 1 to 10, is determined by our machine learning algorithm, which considers factors such as technical failure rates and transaction processing times at the bank data center. High rates of technical failures and slow response times can have a negative impact on the UEI score, which directly affects the overall customer experience. To achieve a superior customer experience, it is recommended to maintain a UEI score of 9 or higher.

The Unified Transaction Map illustrates the flow of UPI transactions across various application layers, including app, web, and other interfaces. By using color indicators, it allows users to quickly identify the touchpoints that have issues in the transaction flow from start to end. One can drill down to identify the exact root cause of the issue and get the system back up as soon as possible.

In conclusion, the UPI Observability ExperienceCenter by VuNet Systems is the game-changer you need for tackling your UPI challenges. With our cutting-edge technology and expertise in the BFSI sector for almost a decade, we can help you overcome technical declines, slow response times, and compliance challenges. Join the ranks of BFSI leaders and experience the difference our platform can make for your business.

You can register to access our UPI Observability Experience Center here. To know more about how VuNet can help you make decisions faster and better via its pioneering Observability tools for business leaders, contact us at [email protected].