The WhatsApp Bot Module interface of VuNet’s Business Observability platform was deployed to streamline communication and collaboration across the ecosystem. Real-time alerts and metrics

In the fast-evolving banking sector, the credit card onboarding process is a critical touchpoint for customer experience. A streamlined and efficient process is essential for attracting and retaining customers in a competitive market. Banks and financial institutions are increasingly focusing on enhancing the customer journey from the initial application to the final activation of the credit card, ensuring a blend of speed, convenience, and security. Further, in the era of co-branded cards, multiple brands are at stake. These partnerships between financial institutions and various merchants require not just efficiency but also brand-enhancing onboarding experiences.

The traditional credit card onboarding process is beset with technological and procedural challenges. Complex workflows that involve numerous internal systems, and the need to interface with third-party credit agencies for credit scoring, add layers of complexity. These factors, combined with outdated technology platforms, often lead to significant delays and a subpar customer experience. The absence of real-time visibility into the process not only affects the time it takes to approve and issue a card but also impacts the overall perception of the financial institution’s brand and services.

The credit card onboarding process is inherently complex. It involves:

● Application Assessment: Rigorous analysis of the applicant’s financial history and creditworthiness.

● Compliance and Verification: Adhering to KYC (Know Your Customer) norms and anti-money laundering standards, which include detailed customer background checks.

● Customized Credit Solutions: Offering personalized credit cards based on the customer’s profile and needs.

● Issuance and Communication: Keeping applicants informed at every stage, addressing queries, and helping. And, upon approval, issuance, and delivery of the card.

Our solution reimagines credit card onboarding with a focus on efficiency and customer experience. Key components include:

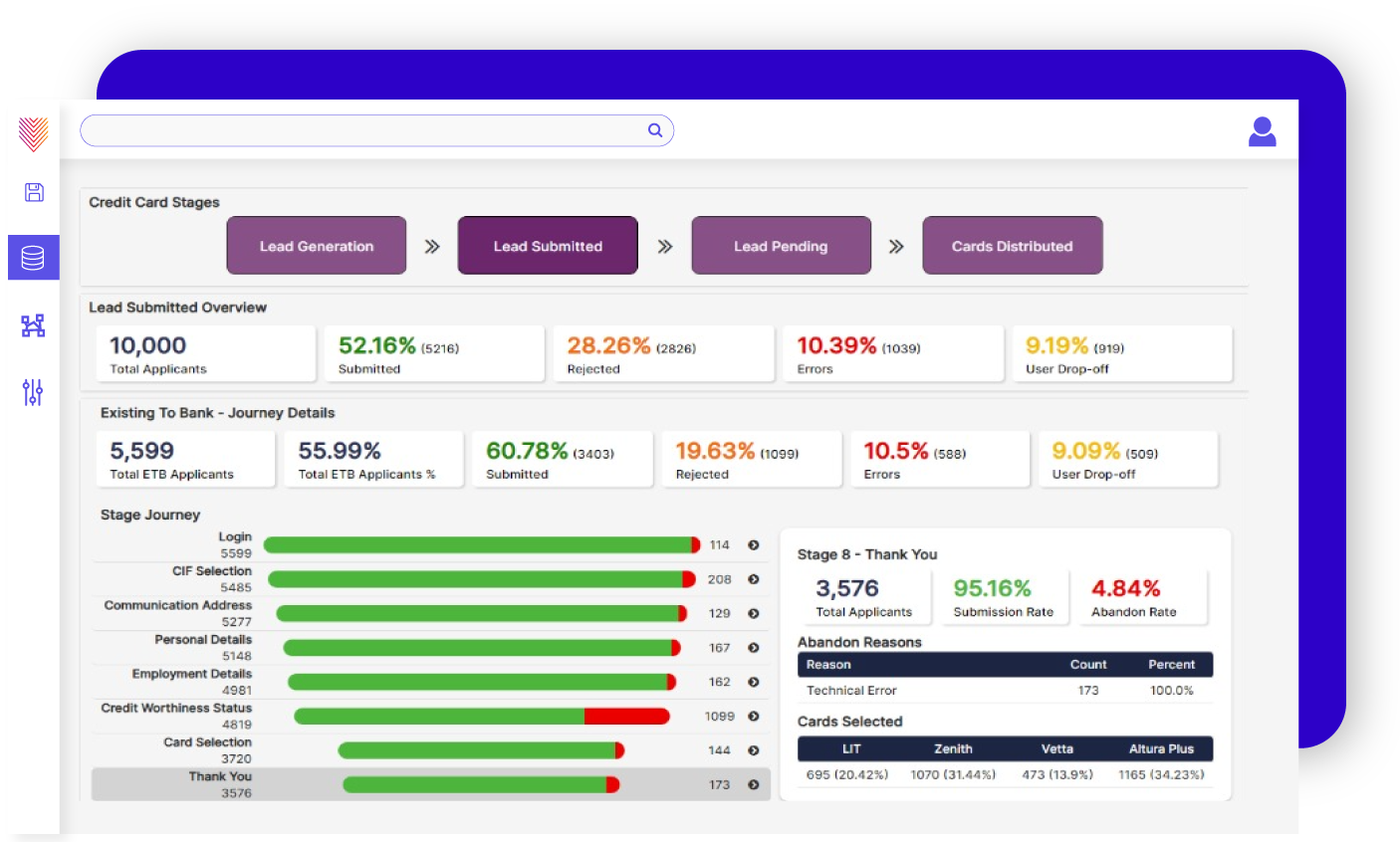

● Real-Time Application Status Visibility: Tracking the number of applications received, processed, rejected, and the drop-off rate. This insight helps identify bottlenecks and improve process efficiency.

● Detailed Stage View and Funnel Analysis: Providing a comprehensive view of each stage of the application process, enabling a clear understanding of where applicants are in the funnel and pinpointing stages with higher drop-off rates.

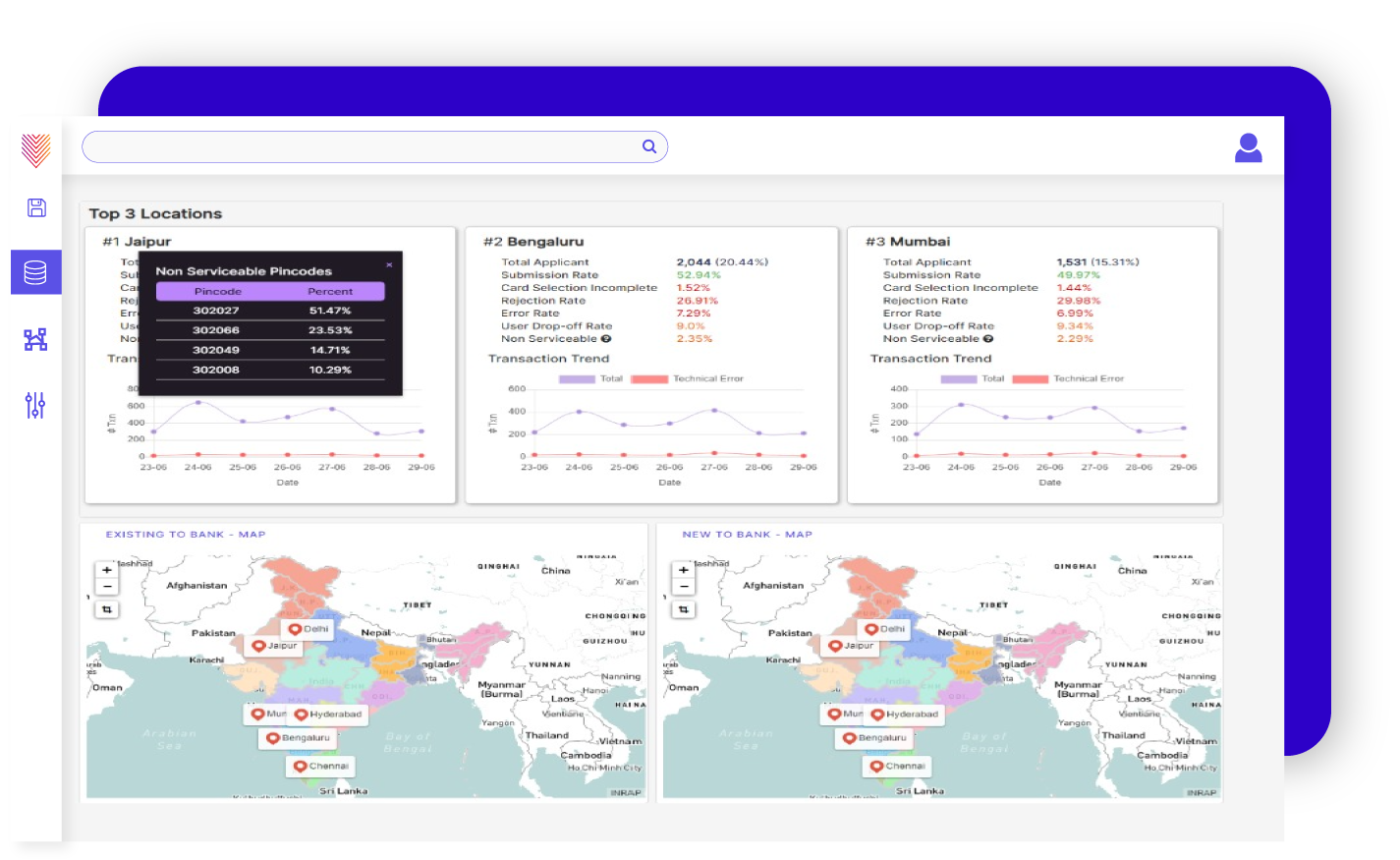

● Segmentation-Based Views: Offering insights based on geography, customer demographics, and channels, allowing for targeted strategies and process optimization.

Real-time monitoring enables organizations to adjust resources during peak onboarding times, ensuring efficient allocation for consistent performance despite fluctuating demand.

Allows for the timely implementation of updates or modifications to the onboarding process to reduce any potential brand image impact / bad customer experience.

Reducing application processing time from days to hours or even minutes based on real-time and historical comparison.

Leveraging customer data for improved product offerings and risk assessment.

Fig – Real-time View of Onboarding Status across Stages

Fig – Segmentation by Geo and View into applications received from non-serviceable locations

The transformation in credit card onboarding is a significant step towards a more digital, customer-centric banking future. By focusing on customer needs and employing advanced technologies, financial institutions can not only enhance operational efficiency but also build stronger, more enduring relationships with their customers.

Browse through our resources to learn how you can accelerate digital transformation within your organisation.

VuNet’s Business-Centric Observability platform, vuSmartMaps™ seamlessly links IT performance to business metrics and business journey performance. It empowers SRE and IT Ops teams to improve service success rates and transaction response times, while simultaneously providing business teams with critical, real-time insights. This enables faster incident detection and response.