The WhatsApp Bot Module interface of VuNet’s Business Observability platform was deployed to streamline communication and collaboration across the ecosystem. Real-time alerts and metrics

In today’s digital-first world, the complexity of financial transactions has increased exponentially. This is particularly evident in the interactions between Banks, FinTech, Trading Exchanges, and Brokers, which are predominantly driven through APIs. In such a connected ecosystem, any technical glitch not only affects the entities involved but ultimately impacts the end customer.

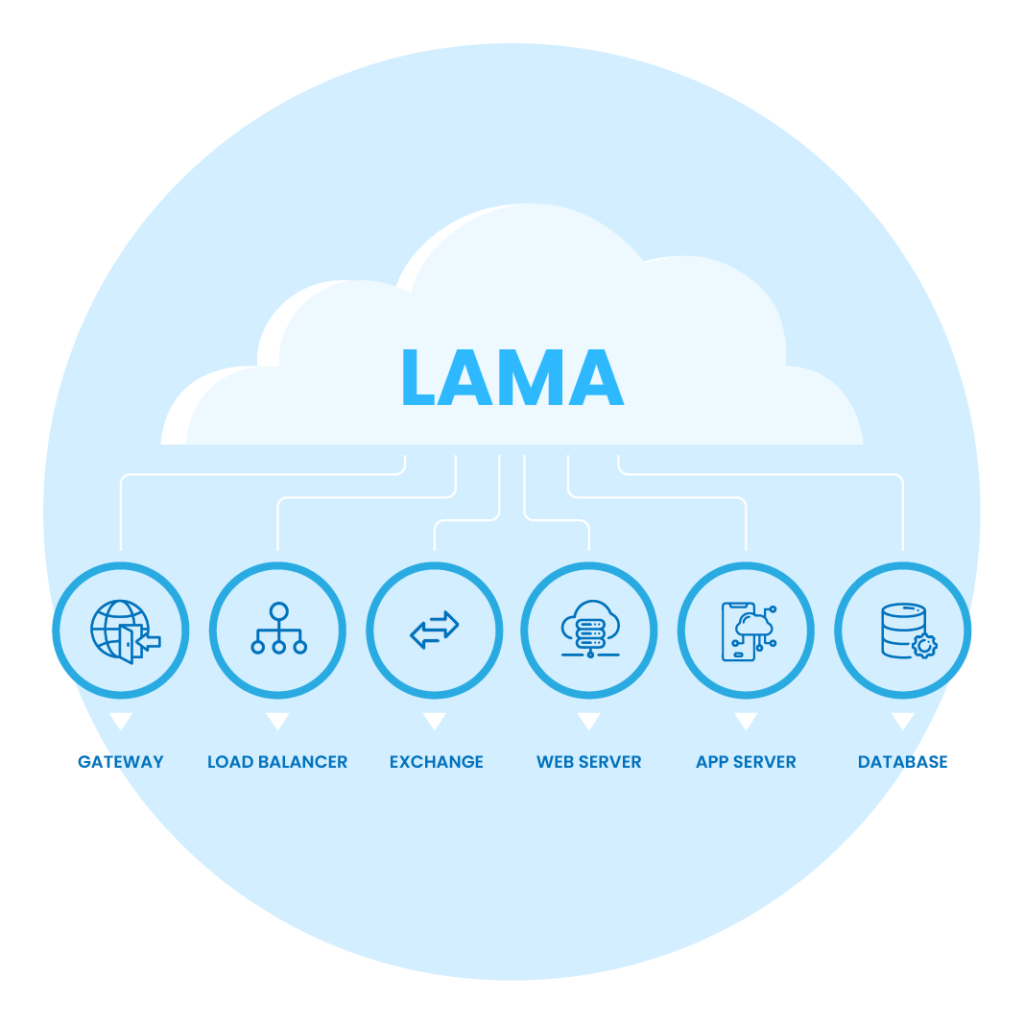

VuNet’s enterprise journey observability platform is uniquely positioned to navigate these complexities, particularly in the context of SEBI’s recent LAMA (Log Analytics and Monitoring Application) regulation.

The Securities and Exchange Board of India (SEBI) introduced the LAMA framework to address “technical glitches” in Stockbroker’s Electronic Trading Systems. This framework mandates the real-time monitoring and analysis of stockbrokers’ critical applications and infrastructure, with a focus on ensuring uninterrupted and efficient trading operations.

● Understanding LAMA’s Objective – Implemented by SEBI to safeguard investors’ interests, LAMA targets the streamlining of technology-related interruptions in trading systems. It’s an API-based system for gathering performance data, allowing real-time insights into trading platforms and facilitating proactive monitoring of technical issues.

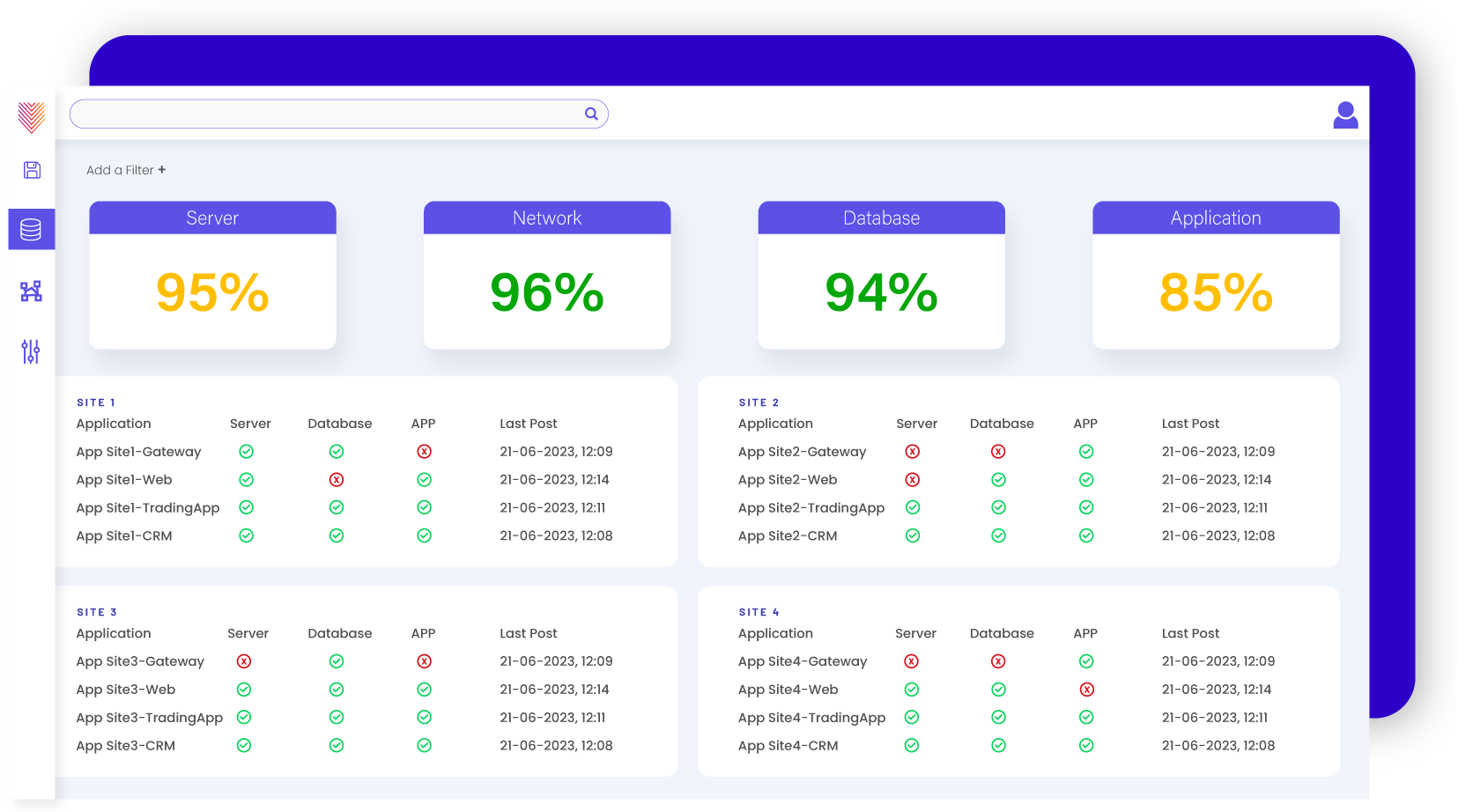

● Challenges in Compliance and Monitoring – While large overseas brokers often have real-time end-to-end monitoring tools, many local brokers either rely on self-developed tools or use disparate systems that lack a unified view. This fragmentation can lead to inconsistent monitoring and challenges in analyzing data in real-time.

The LAMA framework by SEBI represents a critical shift in monitoring technical glitches in electronic trading systems. VuNet’s platform, with its advanced data modeling, enrichment, and customized data set capabilities, address the challenges and requirements of this framework.

The big data-based real-time data collection, correlation, visualization, and notification features of the platform make it a great fit to comply with the guidelines of SEBI in instantly detecting any glitches, reporting, and storing such instances for long-term reporting. Also, the API-based interface enables integration with other systems for notifications and reporting.

● Comprehensive Data Handling: Our platform excels in data modeling, enrichment, and a sophisticated data pipeline, enabling contextual, domain-specific analysis of logs, metrics, traces, and events.

● Scalability: Built for high transaction volumes and concurrency, our big data-based architecture ensures scalability and instant insights.

● Enhanced Storyboarding and Alerts: We offer granular alerts and detailed storyboards, integrating business metrics with operational metrics for quicker anomaly detection and proactive business responses.

● Integrated Communication Channels: Extensive integration capabilities include API links with stock exchanges and communication channels like email, SMS, WhatsApp, and chatbots.

● Future Roadmap with GenAI LLM: Plans to enhance our platform with a GenAI LLM layer aim to improve conversational bots and provide specific, enterprise-relevant insights for faster Root Cause Analysis (RCA).

VuNet’s platform caters to broad personas, from business executives seeking operational insights to L1-L2-L3 engineers requiring detailed technical data. The platform’s ability to connect business metrics with operational data is particularly beneficial for ensuring smooth, compliant, and efficient trading operations in line with the LAMA framework.

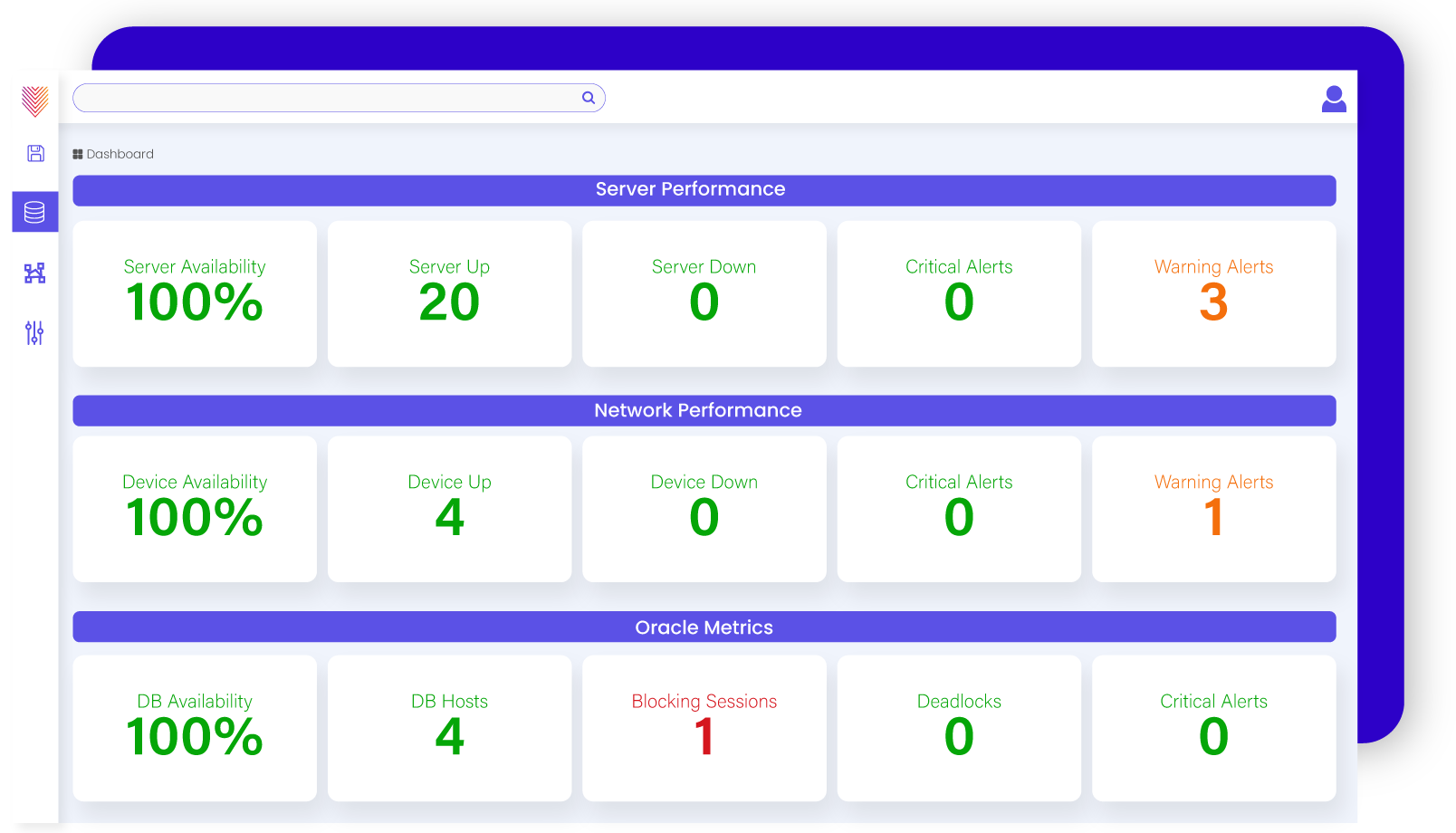

Fig – Real-time Dashboard for Holistic View

Fig – Infrastructure Performance Summary

VuNet is transforming how financial institutions adhere to the LAMA framework. Our platform not only ensures system uptime and regulatory compliance but also offers advanced features that redefine the observability landscape, benefiting a wide range of stakeholders in the financial ecosystem.

Browse through our resources to learn how you can accelerate digital transformation within your organisation.

VuNet’s Business-Centric Observability platform, vuSmartMaps™ seamlessly links IT performance to business metrics and business journey performance. It empowers SRE and IT Ops teams to improve service success rates and transaction response times, while simultaneously providing business teams with critical, real-time insights. This enables faster incident detection and response.