The WhatsApp Bot Module interface of VuNet’s Business Observability platform was deployed to streamline communication and collaboration across the ecosystem. Real-time alerts and metrics

In the dynamic world of corporate banking, particularly in corporate payments, precision and efficiency are crucial. Advanced observability has become an indispensable tool in this realm, ensuring reliable and efficient transactions in the era of digital banking.

Corporate Internet Banking (CIB) encompasses numerous workflows and interfacing with several systems. The stakes are high with vast volumes and concurrency, especially for high-value transactions, where any failure can lead to significant penalties. Real-time visibility across the stages and steps is critical for Banking operations.

Corporate Payment Systems, essential for B2B and personal transactions like salaries and EMIs, involve complex steps:

● File Reception and Validation: Ensuring accuracy and completeness of incoming transaction files.

● Processing and Interfacing: Smooth interfacing with various payment methods (NEFT, RTGS, IMPS, FT) and channels, requiring connections with multiple internal and external systems.

● Acknowledgement and Reporting: Providing timely, accurate post-transaction reports through diverse channels like Web, email, Host2Host, and SFTP.

The business-centric Observability solution offers unified visibility and performance across various workflows and systems, providing unparalleled insights. It uses in-built adaptors and custom hooks in its data pipeline to correlate performance data from logs and databases.

● Custom Metrics and Data Modeling: For nuanced analysis.

● Enhanced Data Analysis: Tailored Insights focused on corporate banking journeys (ex: EMI Payments or Salary Processing)

● Comprehensive Coverage: From payment flow to acknowledgements, each leg of the workflow is meticulously covered.

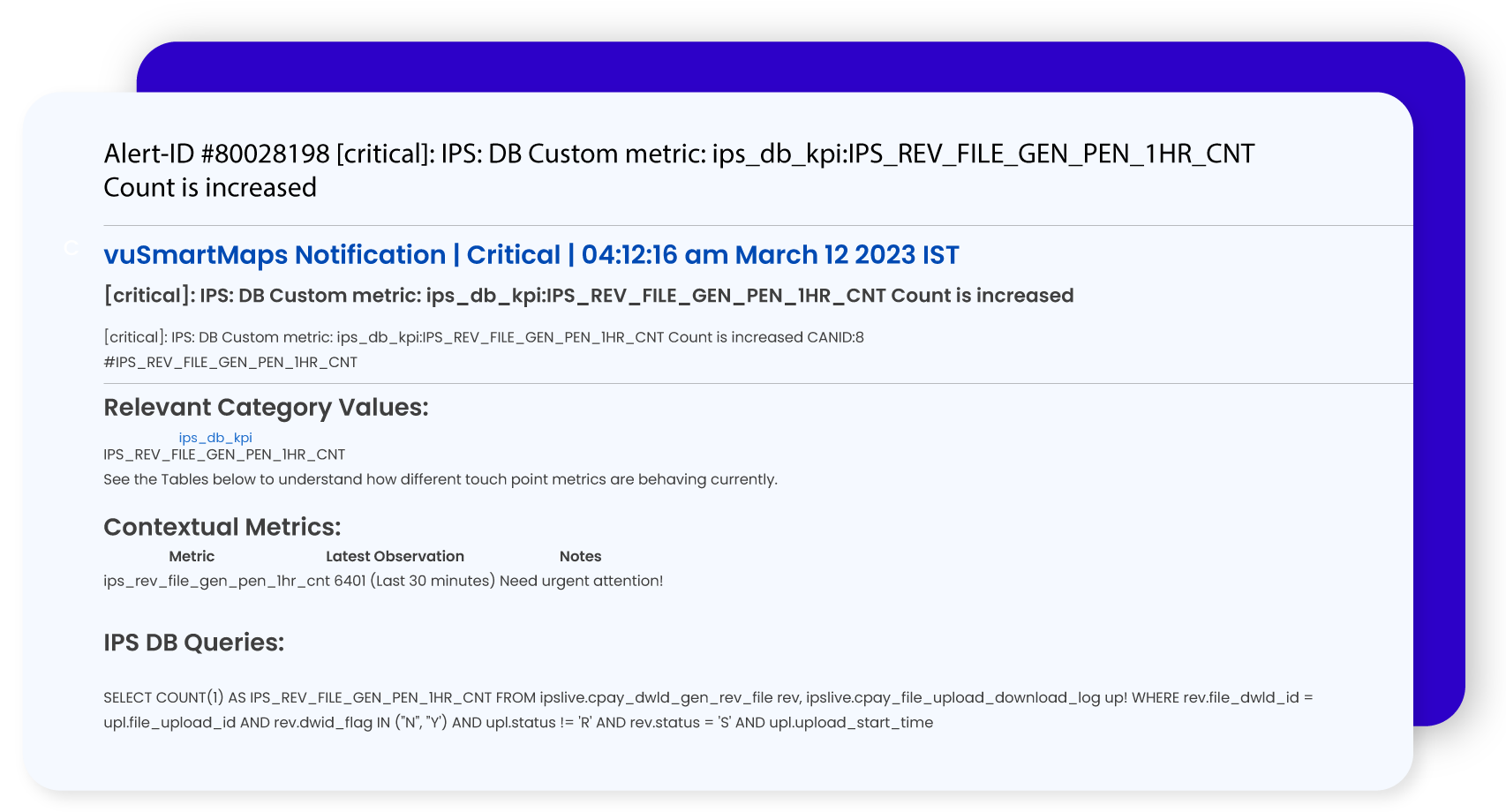

● Customized Alerts: Notifications on processing delays, queue build-up, top corporate customer transaction status etc. via WhatsApp, emails and SMS.

● Extended Workflow to Include CBS: Performance visibility and analysis extend to the Core Banking System, enhancing transaction reliability and speed.

Proactive custom alerts for quicker issue detection and improved response.

Utilizing error analytics and providing stage-wise system visibility to enhance resilience.

Addressing failures proactively, shortening detection and response times, and boosting performance.

Handling daily transactions worth $1-2 billion with increased efficiency and reduced delays.

Achieving over $100K annual savings through unified visibility, automation, improved collaboration, better data correlation, and faster processing, enhancing system effectiveness and scalability.

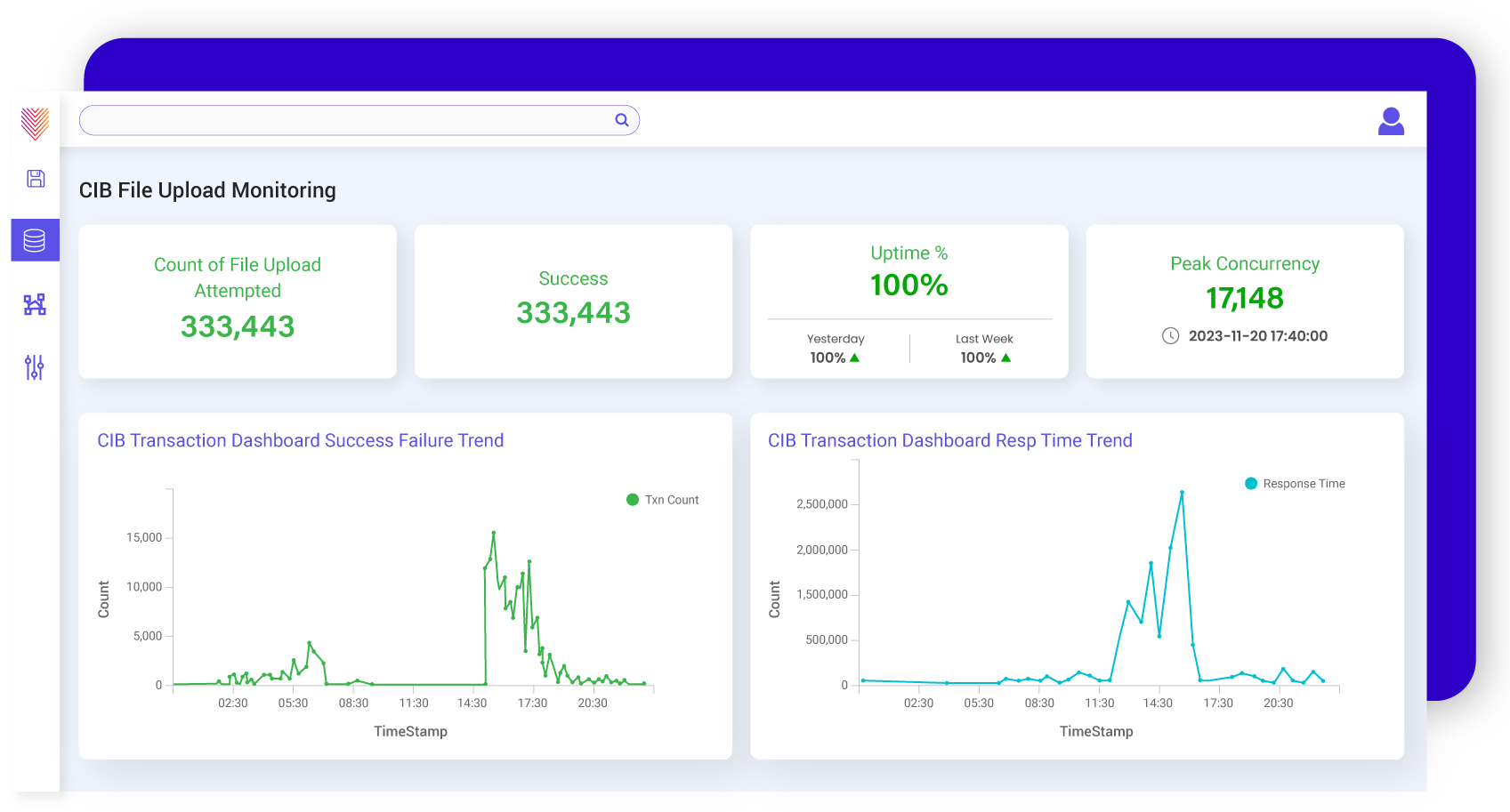

Fig – Real-time visibility into the File Upload Status

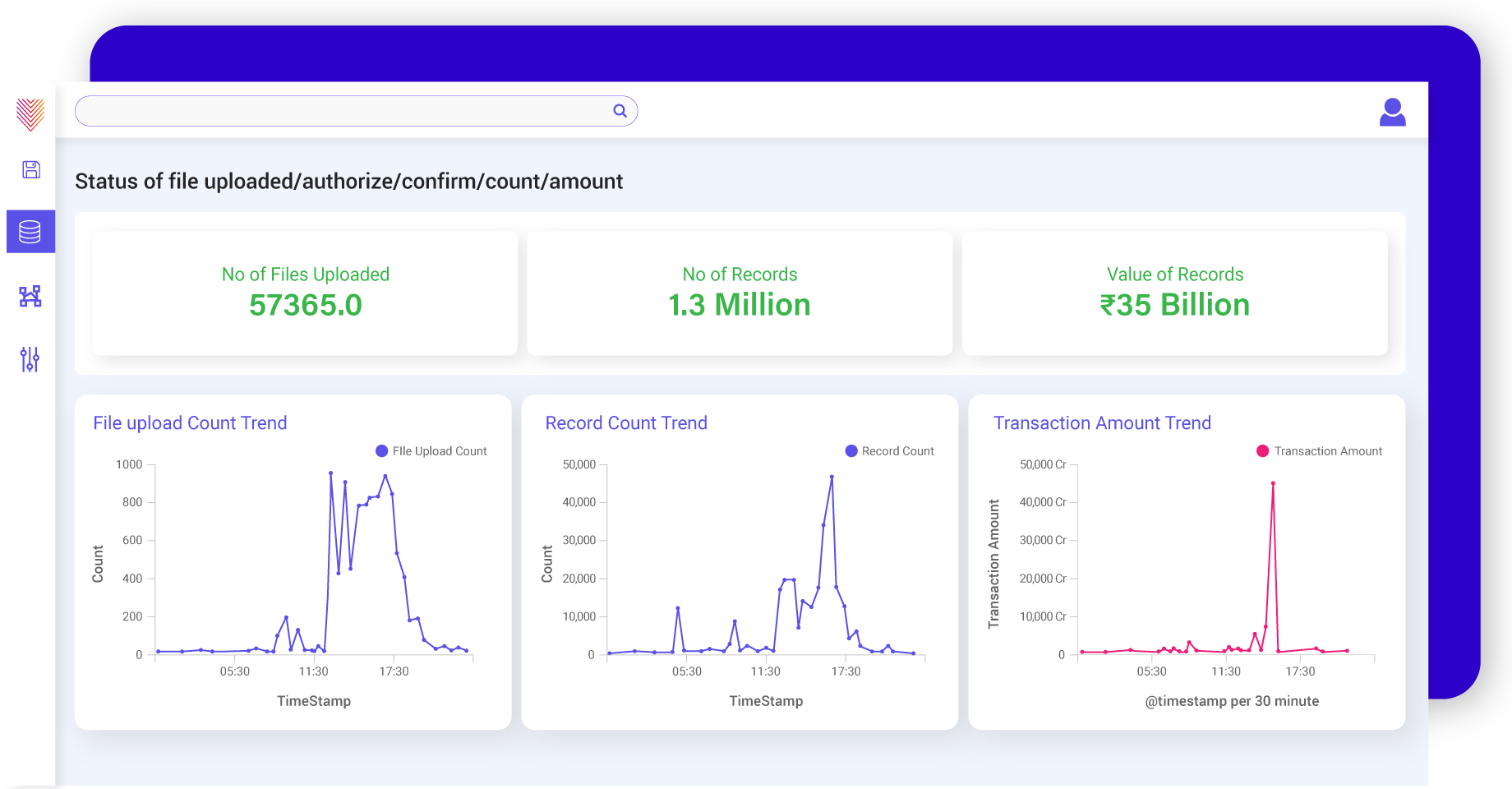

Fig – Real-time visibility into the File Processing Status

Fig – Notification of Pending files exceeding the threshold count

VuNet’s advanced observability on CBS ushers in a new era of digital banking efficiency. It provides financial institutions with the tools to not only meet but also exceed the rapidly evolving expectations of the digital banking landscape. In doing so, it ensures customer satisfaction and operational excellence in a competitive landscape.

Browse through our resources to learn how you can accelerate digital transformation within your organisation.

VuNet’s Business-Centric Observability platform, vuSmartMaps™ seamlessly links IT performance to business metrics and business journey performance. It empowers SRE and IT Ops teams to improve service success rates and transaction response times, while simultaneously providing business teams with critical, real-time insights. This enables faster incident detection and response.