The WhatsApp Bot Module interface of VuNet’s Business Observability platform was deployed to streamline communication and collaboration across the ecosystem. Real-time alerts and metrics

Since its inception, the Unified Payments Interface (UPI) has become a cornerstone of India’s financial ecosystem, facilitating real-time, secure money transfers. As a citizen-scale application, UPI’s success is rooted in its ability to provide an open network for public and private entities, enabling seamless integration and transactions across a range of applications and wallets. The need for observability in such a vast and dynamic environment is critical to maintain efficiency, security, and reliability, ensuring that UPI continues to drive financial inclusion and digital transformation in India.

Managing UPI’s extensive network, which supports more than 350 partner banks and several third-party payment apps, presents several challenges:

● Handling Massive Transaction Volumes: UPI’s growth demands robust Observability systems for real-time performance visibility at scale.

● Complex Ecosystem Management: Seamless visibility across stakeholders like banks, payment providers, and regulators is crucial for tracking performance.

● Ensuring Real-Time Transaction Success: UPI’s need for instant processing requires high system speed and reliability, as any issues affect customer experience and brand reputation.

● Customer Experience and Support: Maintaining consistent, high-quality user experiences and effective support across UPI’s extensive and diverse user base.

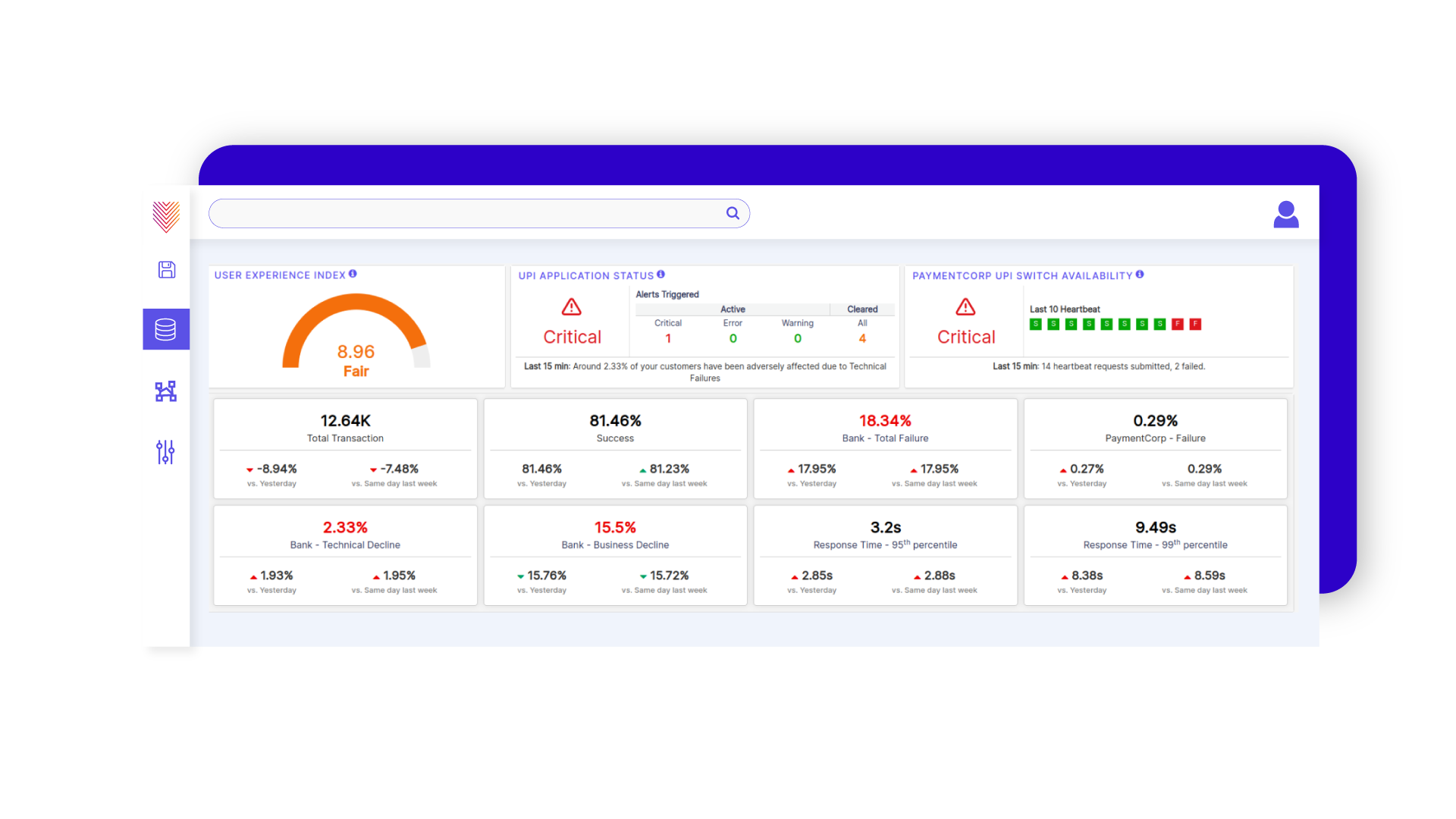

VuNet’s Business-centric observability platform is deployed in several banks to provide end-to-end visibility of UPI journeys. The solution offers:

● Real-time performance tracking of UPI transactions includes latency, error rate, and throughput.

● Micro-journey level analysis offers detailed insights into actions like Pay, Collect, Credit, Debit, and transaction types.

● Transaction tracing across hops supports customer service by following transactions through various stages.

● Business KPI and dimensional analytics provide immediate performance degradation alerts and insights at both aggregate and transaction levels, considering dimensions like Payee PSP, Payer PSP, and geographic locations.

● Intelligent, correlated notifications alert based on business impact, integrating business, operational, and customer experience perspectives.

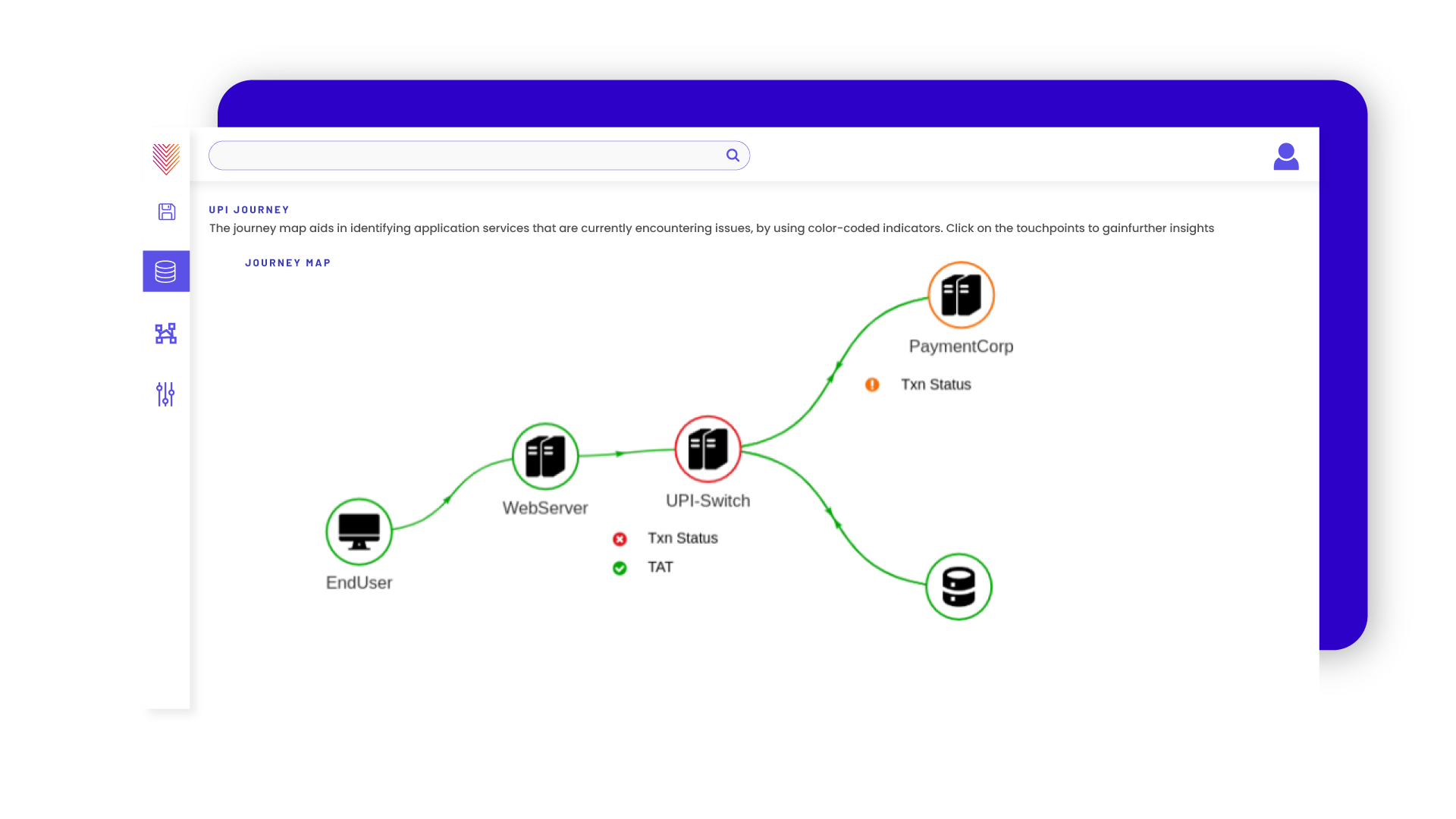

The VuNet’s Business-centric Observability Solution provides holistic visibility into the entire process enabling real-time detection of the application, diagnosis of the errors and intelligent notification. The solution consists of:

● Real-time Performance Insights: Detect any performance degradation across the journey and drill down to APIs / components contributing to the failures.

● Custom Analytics and Real-time Reporting: For granular insights into every step of the loan process, aiding in decision-making and identifying bottlenecks.

● Automated Alerts and Process Optimization: Enhancing efficiency and reducing loan processing time.

● Comprehensive Data-Driven Analysis: Utilize advanced algorithms for accurate analysis of the loan data by various segmentation – such as loan type, customer demographics, payment type etc. to enable better targeting and conversions.

Faster issue detection and resolution, improving system reliability.

Enhanced transaction journey visibility improves success rates.

Error segregation and responsibility assignment (bank, payer PSP, acquirer bank, or regulator), increasing transparency and accountability.

Identifying potential issues, like device registration failures, before they escalate.

Enhanced performance visibility, including regulatory interfaces, aids in addressing recurring issues and better capacity forecasting, strengthening payment infrastructure resilience.

Fig – Real-time visibility of Instant Payments as seen on vuSmartMaps

Fig – Real-time visibility of Instant Payments as seen on vuSmartMaps

Implementing VuNet’s observability platform in UPI payment processes marks a significant step towards digital payment excellence. By leveraging real-time data and analytics, banks and financial institutions can not only enhance operational efficiency but also improve customer satisfaction in the digital payment ecosystem.

Browse through our resources to learn how you can accelerate digital transformation within your organisation.

VuNet’s Business-Centric Observability platform, vuSmartMaps™ seamlessly links IT performance to business metrics and business journey performance. It empowers SRE and IT Ops teams to improve service success rates and transaction response times, while simultaneously providing business teams with critical, real-time insights. This enables faster incident detection and response.