The WhatsApp Bot Module interface of VuNet’s Business Observability platform was deployed to streamline communication and collaboration across the ecosystem. Real-time alerts and metrics

In today’s digital era, the lending sector is undergoing a transformative shift. Integrating technology in lending processes is beyond an operational change, a strategic move towards more efficient, risk-aware, and customer-centric services. Lenders are now turning to advanced technologies to navigate the complexities of loan processing, striving to meet the rapidly evolving demands of both the market and their customers.

Lending institutions are grappling with several challenges in this digital landscape:

● Intricate Loan Processing Workflows: The journey from loan application to disbursement involves numerous steps, each with its own set of complexities.

● High-Volume Transaction Handling: With a surge in digital transactions, managing the sheer volume of loan applications is daunting.

● Compliance and Risk Management: Adhering to strict regulatory requirements and efficiently assessing loan risks remain paramount concerns.

● Diverse Customer Expectations: Today’s borrowers expect quick, transparent, and personalized loan services.

Lending systems are intricate, involving several interconnected components:

● Varied Loan Application Processes: Each loan product, whether a mortgage, personal, or auto loan, requires a distinct processing approach and involvement of multiple IT systems and supporting infrastructure.

● Seamless Integration with Payment Systems: Ensuring efficient and error-free connections with payment gateways for transaction processing.

● Accurate and Timely Reporting: Essential for both internal management and regulatory compliance.

● Enhancing User Experience: Providing a frictionless and transparent journey for applicants, from inquiry to loan disbursement.

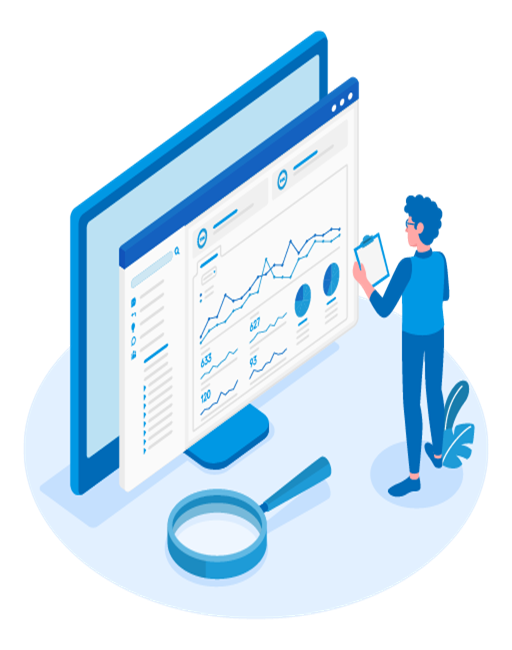

The VuNet’s Business-centric Observability Solution provides holistic visibility into the entire process enabling real-time detection of the application, diagnosis of the errors and intelligent notification. The solution consists of:

● Real-time Performance Insights: Detect any performance degradation across the journey and drill down to APIs / components contributing to the failures.

● Custom Analytics and Real-time Reporting: For granular insights into every step of the loan process, aiding in decision-making and identifying bottlenecks.

● Automated Alerts and Process Optimization: Enhancing efficiency and reducing loan processing time.

● Comprehensive Data-Driven Analysis: Utilize advanced algorithms for accurate analysis of the loan data by various segmentation – such as loan type, customer demographics, payment type etc. to enable better targeting and conversions.

Each loan product, whether a mortgage, personal, or auto loan, requires a distinct processing approach and involvement of multiple IT systems and supporting infrastructure.

Ensuring efficient and error-free connections with payment gateways for transaction processing.

Essential for both internal management and regulatory compliance.

Providing a frictionless and transparent journey for applicants, from inquiry to loan disbursement.

Fig – Real-time visibility of various critical applications seen on vuSmartMaps

The future of lending lies in embracing technology. Advanced observability tools are redefining the way loans are processed, leading to a paradigm shift in the lending industry. These technologies not only streamline operations but also open new avenues for innovation in customer service and risk management.

Browse through our resources to learn how you can accelerate digital transformation within your organisation.

VuNet’s Business-Centric Observability platform, vuSmartMaps™ seamlessly links IT performance to business metrics and business journey performance. It empowers SRE and IT Ops teams to improve service success rates and transaction response times, while simultaneously providing business teams with critical, real-time insights. This enables faster incident detection and response.