The WhatsApp Bot Module interface of VuNet’s Business Observability platform was deployed to streamline communication and collaboration across the ecosystem. Real-time alerts and metrics

The Core Banking System (CBS), epitomized by robust solutions like Finacle, is the linchpin of any financial institution’s operations. Its paramount role in facilitating critical banking transactions across multiple channels cannot be overstated. In an era of digital banking, CBS’s uninterrupted functioning is not just expected; it’s imperative. The seamless operation of CBS ensures that whether it’s a routine inquiry or a complex transaction, the customer’s experience is efficient and interruption-free.

Banks today navigate a minefield of operational challenges with their CBS. These range from managing high transaction failure rates that frustrate customers to grappling with the opacity of those failures’ root causes. The challenge is always identifying the source of a problem – is it at the infrastructure layer or within the application, or in the upstream channel. Moreover, financial institutions are under the microscope of regulatory bodies, facing potential penalties for any downtime that hinders customer transactions. These challenges are magnified by the expectation of providing uninterrupted service, as CBS is the backbone that supports the entire banking operation.

The CBS ecosystem is a tapestry of interconnected subsystems. The typical landscape consists of Connect24, Uniserver, and CSIS all converging on Finacle, forming a complex network that supports the bank’s day-to-day operations. Each subsystem is a cog in the larger machine, and any disruption can have cascading effects, impacting the overall integrity and performance of CBS. The task of managing these systems, with their interdependencies and nuances, requires a level of visibility that traditional monitoring tools simply cannot provide. Further, being the downstream system where all the different payments and transactions land, intricate knowledge of the payment flows, and the nature of the payment journey is crucial to isolate the degradation and impact.

To cut through this complexity, VuNet offers an observability solution tailored to the nuanced needs of financial institutions. This platform goes beyond mere system checks, offering real-time visibility into CBS’s performance and a comprehensive overview of channel performance. It’s a holistic observability of the ecosystem that scrutinises CBS’s internal workings and keeps an eye on every channel that feeds into it along with the different layers of applications and interfaces leading to the CBS. From ATM transactions to online banking requests, VuNet’s solution ensures that every touchpoint is a point of strength, not vulnerability.

Offering real-time, continuous insights into CBS performance, the solution acts as an early warning system for potential issues.

It provides a granular view of each transaction channel’s performance, ensuring optimal function and rapid issue identification.

Advanced analytics facilitate the early detection of anomalies, preemptively addressing issues before they impact customers.

The platform’s ability to identify and analyze upstream system impacts allows for precise and accelerated response.

A reduction in Mean Time to Detect (MTTD) and Mean Time to Repair (MTTR) leads to increased system uptime and operational continuity.

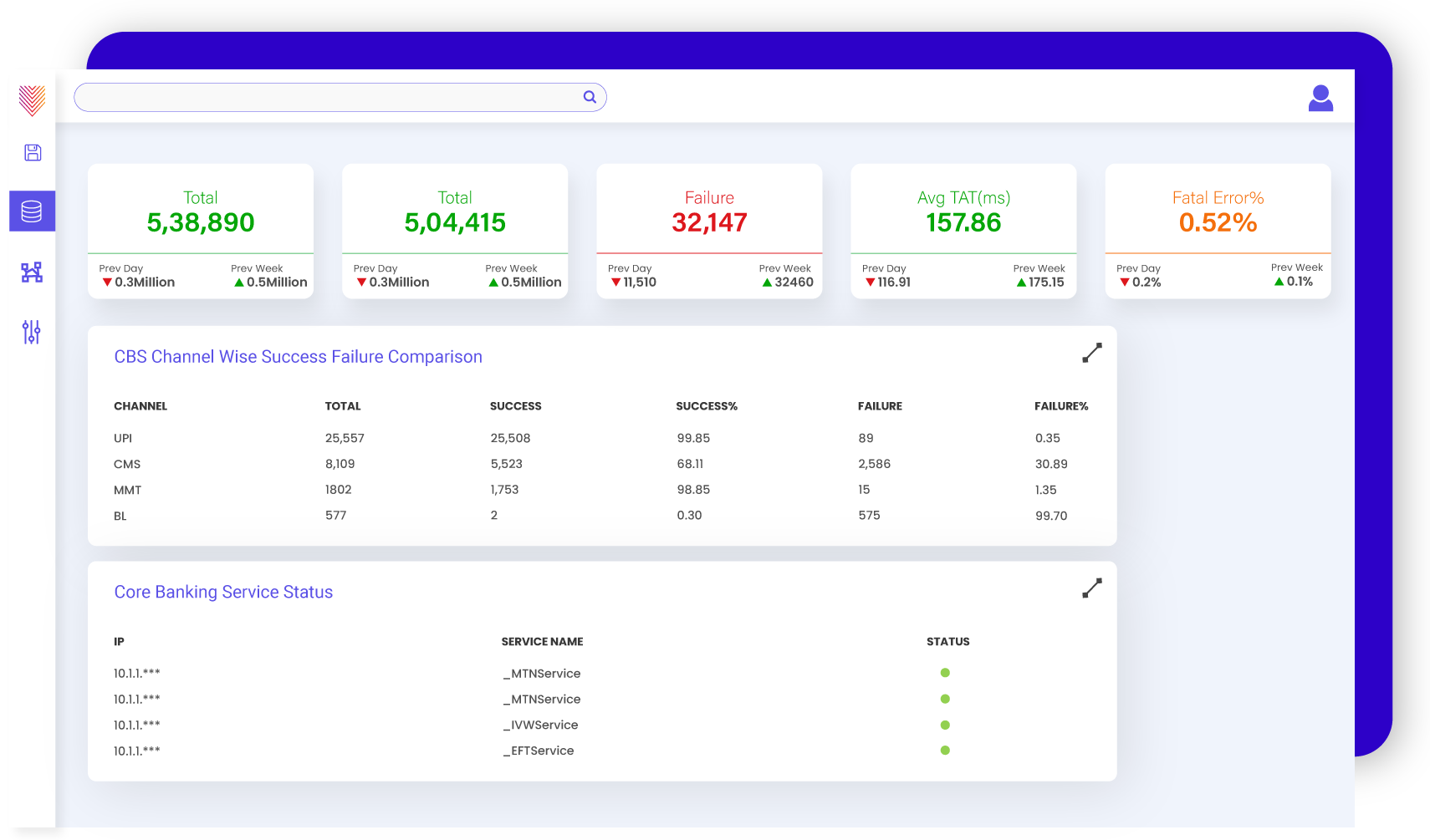

Fig – CBS Transaction Summary with Service and Channel Performance Status

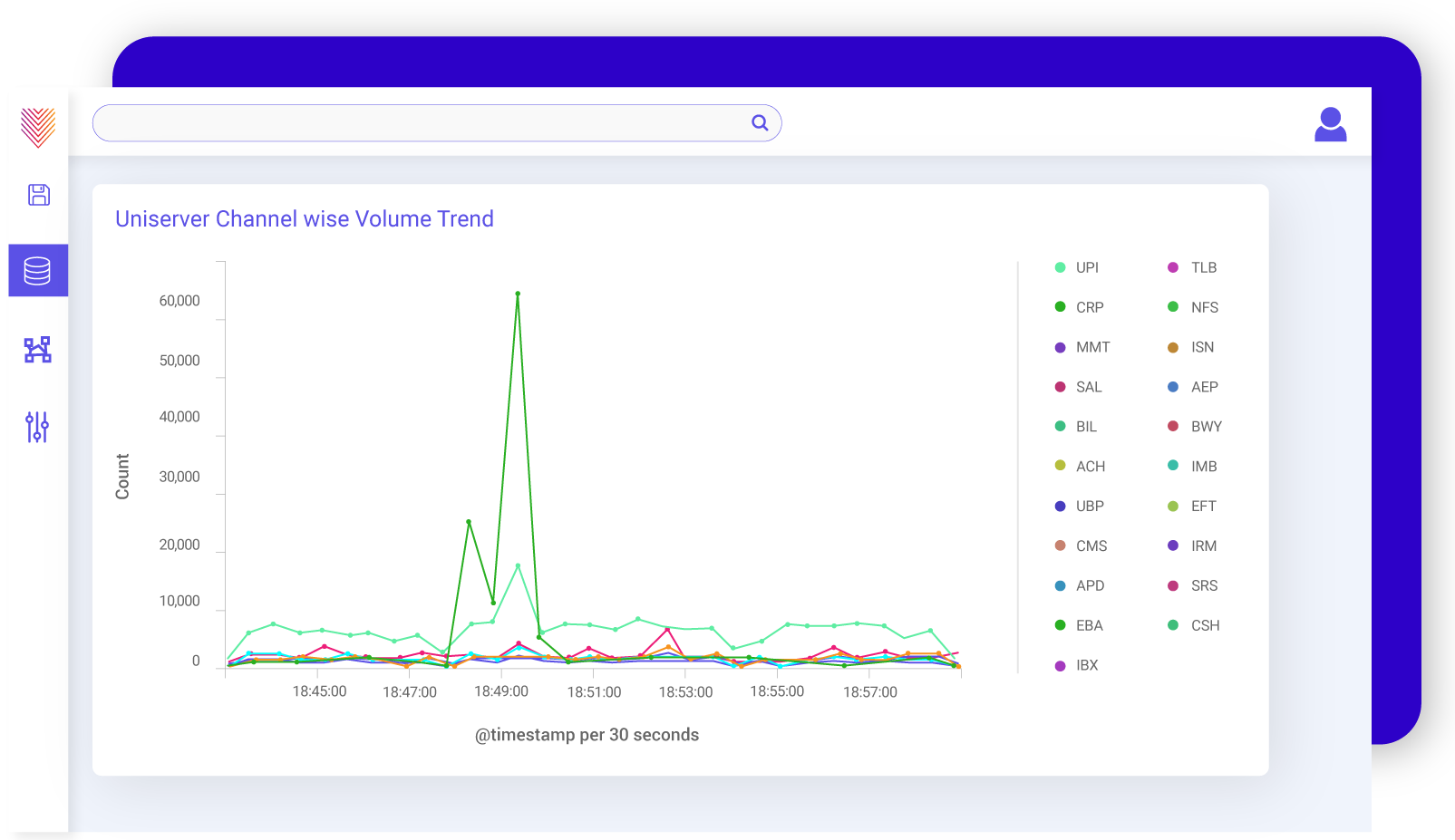

Fig – Uniserver Channel-wise volume Trend

VuNet’s advanced observability on CBS ushers in a new era of digital banking efficiency. It provides financial institutions with the tools to not only meet but also exceed the rapidly evolving expectations of the digital banking landscape. In doing so, it ensures customer satisfaction and operational excellence in a competitive landscape.

Browse through our resources to learn how you can accelerate digital transformation within your organisation.

VuNet’s Business-Centric Observability platform, vuSmartMaps™ seamlessly links IT performance to business metrics and business journey performance. It empowers SRE and IT Ops teams to improve service success rates and transaction response times, while simultaneously providing business teams with critical, real-time insights. This enables faster incident detection and response.