The WhatsApp Bot Module interface of VuNet’s Business Observability platform was deployed to streamline communication and collaboration across the ecosystem. Real-time alerts and metrics

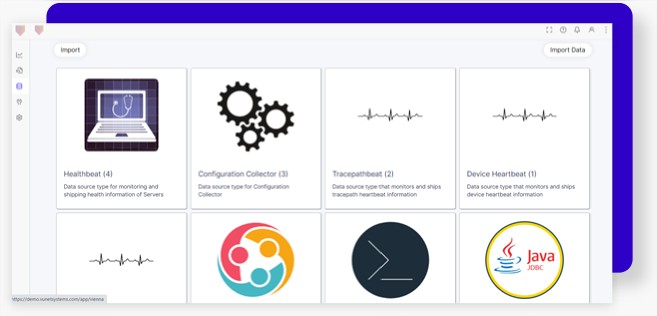

Capture data from any source in real-time and map it to predefined industry-specific data formats

Get support from our well-defined and extensive common data model

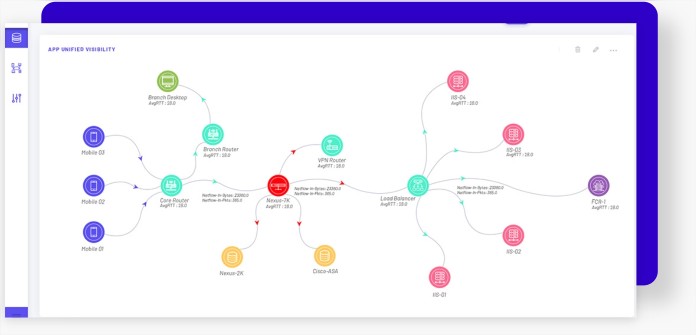

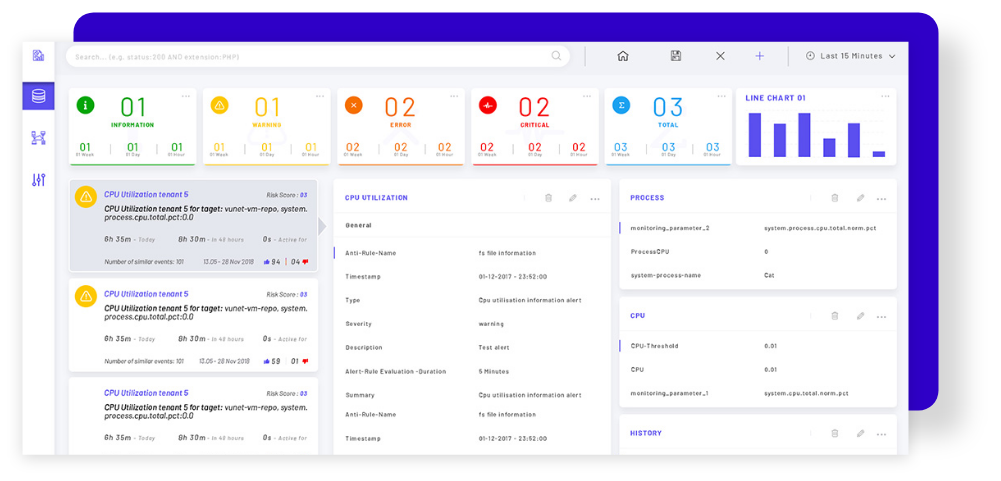

Real-time view of data enriched with business, domain and environment context

Get a unified view of transaction data across multiple touchpoints with the dynamic correlation of data.

Identify the impact of issues and avert business impact and revenue loss.

Get faster issue identification and RCA for quick incident resolution.

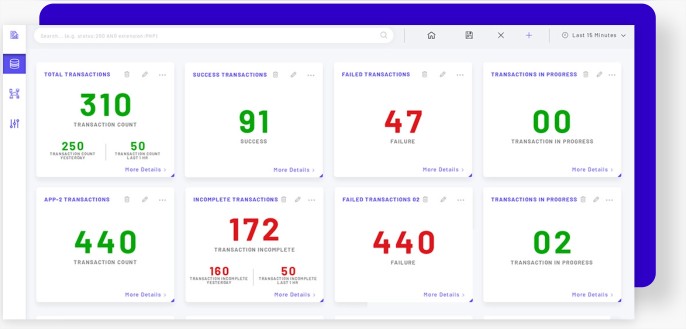

Customise and create your own KPIs and storyboards with an available library of widgets.

Patent pending 3T data correlation approach allows for better business insights and outcomes.

Industry-standard data definitions and scalable data lake allow for better data discovery with no data loss.

Better collaboration between teams, easing issue resolution for enhanced customer experience.

Forecast failures and anomalies in the behavior of systems and signals with ease, using the MLOps capability.

Generate predictive, contextual, and correlated alerts in real-time with ML-based data aiding for higher efficiency.

Receive contextual and correlated alerts at your convenience via email, SMS, WhatsApp or other channels.

View transactions as your customer’s experience it and provide frictionless service.

Monitor data and create your own KPIs to predict future incidents with granular drill-downs that allow quick RCA and resolution.

Find a pricing plan that best suits your needs.

VuNet’s Business-Centric Observability platform, vuSmartMaps™ seamlessly links IT performance to business metrics and business journey performance. It empowers SRE and IT Ops teams to improve service success rates and transaction response times, while simultaneously providing business teams with critical, real-time insights. This enables faster incident detection and response.