Augment FRM Systems with Business Journey Observability: Insights and possibilities into preventing fraud

- Mar 29, 2024

- Blogs

- 5 min read

Introduction

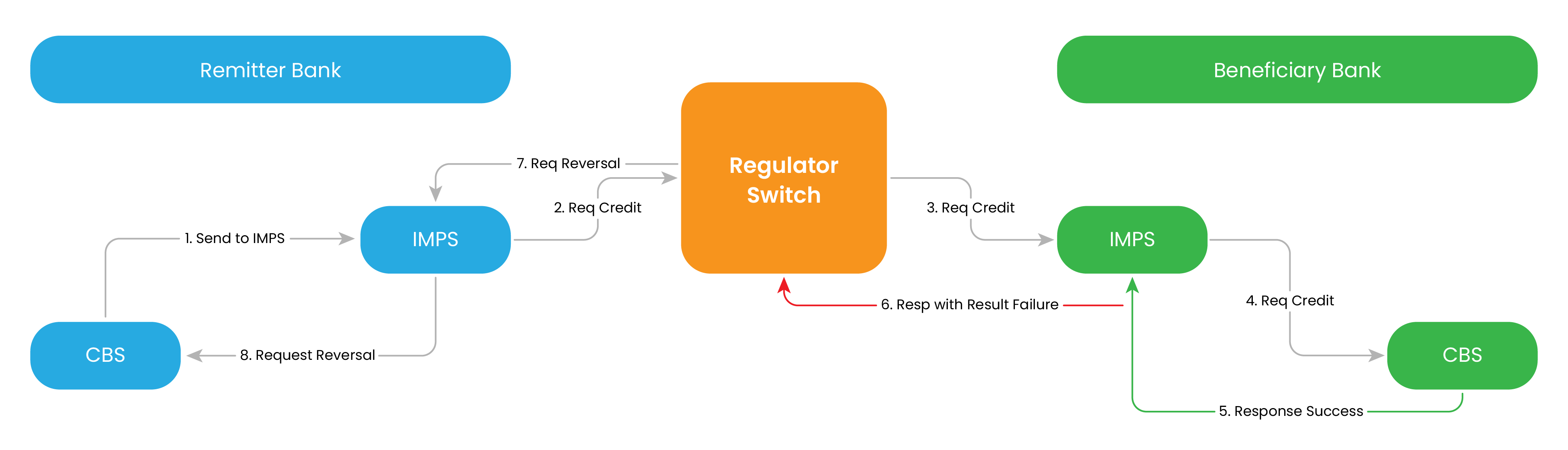

In a startling revelation that came to light between November 10 and 13, 2023, UCO Bank found itself at the centre of a technological anomaly that led to the erroneous transfer of approximately Rs 820 crore through the Immediate Payment Service (IMPS) platform. This fraudulent activity saw vast sums credited to the accounts of numerous bank customers without corresponding debits from the accounts initiating these transfers. As the saga unfolded, it was discovered that the transactions originated from about 14K account holders across private banks, leading to unauthorized withdrawals by the beneficiaries.

The sheer magnitude and the sophisticated nature of this incident cast a spotlight on the challenges within the traditional Fraud Risk Management (FRM) approach, which could not detect or prevent the anomaly in real-time or even shortly thereafter. From publicly available data, this episode possibly involved issues with the bank’s IMPS payment switch, sending false failure notifications to the regulator, while successfully crediting beneficiary accounts.

Understanding Digital Transaction Flow

Understanding FRM and Current Processes

FRM systems in banks traditionally analyze transaction patterns, flagging anomalies, and employing rules-based engines to prevent fraudulent transactions. This is what you would call an “inline system” where processes are designed to identify inconsistencies in transaction behavior, scrutinize high-risk activities, and initiate alerts for potential fraud. But they wouldn’t have a unified view of transaction success/failures. An alternative method for identifying such frauds could have been through reconciliation processes. However, these are typically conducted two to three days later. By this time, the accounts of fraudulent customers would already have been debited, rendering delayed reconciliation ineffective for preventing these incidents. In conclusion, the complexity and sophistication of modern banking fraud, as illustrated by the case of UCO Bank, necessitate the adoption of more advanced, real-time, and predictive strategies in fraud detection and prevention.

The Imperative for Enhanced Fraud Management

The recent incident highlights the necessity to augment our approach towards fraud management with platforms that offer unified visibility like Business Journey Observability platforms

It’s evident that a more profound Observability of transaction logs, with a focus on business journeys, could significantly enhance the detection and flagging of anomalies in real-time. Such cases highlight the necessity for a shift in approach.

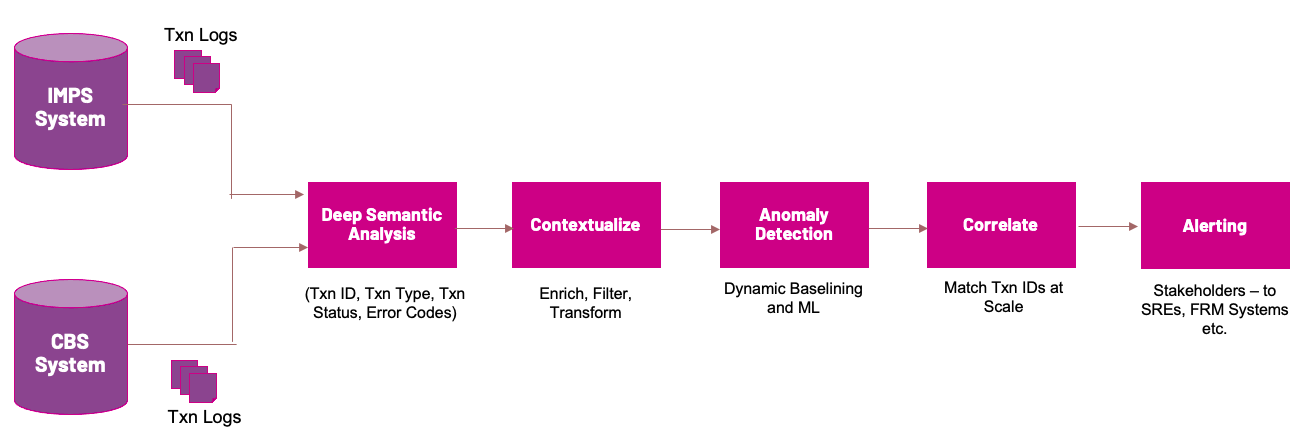

In this enhanced scenario, an Observability platform would ingest logs on a large scale from both the Immediate Payment Service (IMPS) and Core Banking System (CBS) applications. This platform would contextualize and correlate data in real-time, employing various methods to flag anomalies. Among these methods are velocity checks on response or error codes and correlation checks across different touchpoints, illustrating just a few potential strategies.

Diving deeper, the implementation of more sophisticated semantic analytics on application transaction logs emerges as a pivotal element in bolstering fraud detection capabilities. By applying AI/ML models, the platform could flag anomalies and execute advanced, real-time correlations at scale. This approach aims to significantly enhance the signal-to-noise ratio, offering a more nuanced and effective method for identifying fraudulent activities.

Essential Strategies for Flagging Fraudulent Incidents

With platforms like the Immediate Payment Service (IMPS), digital payments, and lending systems processing tens of millions of transactions daily, observability systems must have the capacity to analyze terabytes of data. This enables the immediate application of rules to detect and mitigate fraud. Here are several advanced strategies that can be incorporated into observability platforms to efficiently ingest, analyze, contextualize, correlate, and generate alerts for potential fraud scenarios as they occur:

- Sudden Spikes in Failure Rates: Utilize machine learning algorithms to monitor and alert on atypical increases in transaction failure rates, acting as a preemptive indication of potential fraud.

- Velocity Checks: Implement monitoring of transaction volumes and values across various dimensions, including bank BIN codes, error codes, response codes, volumes, values, and geographic locations. This helps identify anomalies that could signify fraud, such as unusually frequent transactions or significant changes in transaction values.

- Correlation Analysis: Perform real-time correlation analysis between transactional data from the IMPS switch and Core Banking System (CBS), including response and error codes, to detect inconsistencies that may indicate fraudulent activity.

- Audit Log Analysis: Examine changes to system configurations within the IMPS framework, flagging unauthorized modifications. When these are correlated with sudden increases in transaction failure rates, it could signify an attempt at fraud.

These strategies represent a blend of innovative rules and capabilities designed to enhance the efficiency of observability platforms in identifying and alerting on fraud in real-time, ensuring a more secure digital transaction environment.

Conclusion

The UCO Bank case has highlighted significant deficiencies in analyzing fraud only through the prism of FRM systems. A business journey observability platform, enhanced with machine learning and MLOps capabilities, offers a comprehensive and scalable solution to reinforce existing fraud management infrastructures. By integrating such a cutting-edge platform, banks can strengthen their capacity to identify and counteract fraud instantaneously, thereby markedly improving their operational resilience.

In the current intricate landscape of digital banking, the transition towards agile and responsive fraud management is indispensable. Leveraging business journey observability enriched with machine learning innovations empowers banks to protect their operations and maintain customer trust in an era of increasing digital vulnerabilities.

Enhanced use cases from VuNet’s Business Journey Observability Platform

As a business journey observability platform, VuNet is broadening its scope and use cases to specifically tackle fraud, leveraging its unified, big data and MLOps architecture to not only ingest logs at scale but also create domain-centric rules and context for detecting and correlating such anomalies from real-time transaction information. The alerts are further enhanced with API integrations with the FRM systems to provide additional context in real time for fraud prevention. Through VuNet, financial institutions are equipped to not only make significant strides in operational efficiency and customer satisfaction but also now fortify their fraud, security and compliance measures as well.