Unified visibility for a successful UPI transaction

- Nov 22, 2022

- Blogs

- 30 min read

UPI is the buzz word these days. Making payments in an instant, digitally, gives us a sense of control. That nice feeling fades when the payment fails, even after subsequent attempts. It makes one feel let down, the same feeling when your card comes invalid when swiped. Do you want to know why your payment failed?

With the explosive growth of digital payment and UPI transactions, the IT operational systems are still changing to meet the new-age demands. As such the traditional IT systems are complex and distributed and each transaction traverses through varied touchpoints, crossing perimeters. One can imagine, the strain such a surge in transaction volumes can inflict on the IT systems, resulting in transaction failures. So, when a single payment failure is a revenue loss, coupled with a bad user experience, it forces one to think from first principles especially from the monitoring angle.

In case of payment gateways such as Google Pay, Amazon Pay etc. while they have handled high transaction volumes, the biggest challenge they face is envisaging and providing visibility through a multi-system, multi-persona banking layer. Even for them, the lack of providing a seamless experience causes loss of trust and revenue loss.

Now imagine, the banks / payment gateways through which you were making the payment were informed ahead of time of any potential issues in their systems or infrastructure. This visibility will have them prepared to manage the situation and avert transaction failure.

The key to achieving this is VISIBILITY!

Providing a unified visibility cutting across the application, database, server, network, firewall and other infrastructure layers provides a better handle on what, where and why the transactions are failing. Imagine, if this visibility was elevated from an IT issue to a business transaction journey – Enterprises can then make a greater assessment of the issues and work on appropriate remediation and mitigation, thus limiting failed customer experiences.

This is where a unified observability solution steps in, which combines big data, machine learning and rich, intuitive visualization to provide the IT operations team of enterprises a single pane real-time view of the issues affecting their IT network. Big data and operational analytics aids in easier consolidation of machine data across an enterprise into a single pane of glass view, aiding in the correlation of information across sources for deep insights and adapt to changing business requirements.

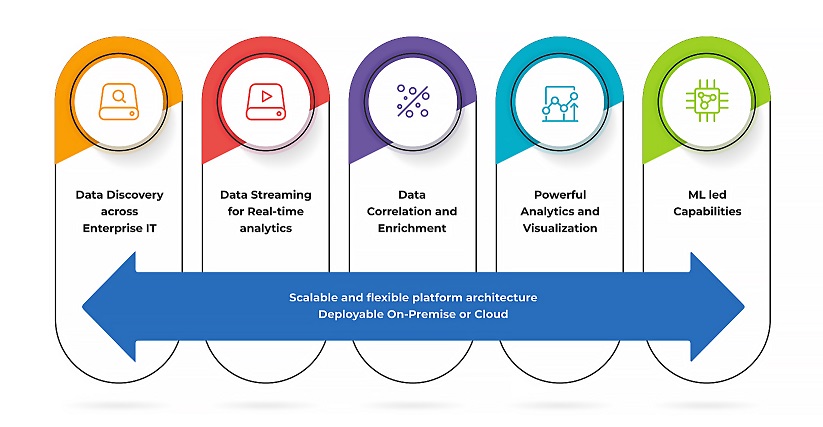

Let us look at what are the key constituents of a Unified Observability solution!

📌Data discovery across enterprise IT

- Real-time telemetry data captured from disparate, silo-ed data sources

- Flexible adaptors for normalizing data and easily capture data for new use cases

- Architected for scale and availability to prevent loss of even single data and manage large data volumes

📌Data streaming for real-time analytics

- Deliver analytics not required in real-time but require processing high volumes of data

📌Data correlation and enrichment

- Powerful event correlation from data across data sources helping in breaking data silos and provide super-fast insights

- Takes a system-based approach for problem solving instead of point analysis such as log analytics, monitoring etc.

📌Powerful analytics and visualization

- Rich and intuitive visualization providing a single pane of truth

- Storyboards to help see story behind any incident

- Faster root-cause analysis with drill down of KPIs

- Role based views with drill-downs to get the level of KPI required

- Proactive issue identification and alerting

📌Extensive use of Machine Learning algorithms for

- Anomaly detection

- Predictive capabilities by pattern recognition of incidents and behavioural learning of environments

- Smart actionable alerting

📌Scalable and flexible platform architecture

- Providing for customizations of use cases to fit an enterprise landscape

- Extensibility for future use

- Seamlessly integrate with ITSM tools for automation and faster remediation

📌Architected to deliver the platform on-premise and cloud

Benefits delivered by a Unified Observability Solution

- Exceptional customer experience

- End-to-end business journey visibility in real-time, connecting business and IT

- Proactive and faster issues identification and remediation

- Analytics with actionable insights for improved user experience

- Improves security and enhance the efficiency of IT infrastructure

- Improved productivity of team by enabling faster RCA, alert-based actions

Now that we have revealed what you should look for in a Unified observability solution, let us tell you all solutions are not equal. One must take a cognitive approach to selecting a solution based on the current as well as future needs of the organization. You will need to assess how the solution provides a better digital experience and helps accelerate your digital transformation initiatives.

Best Fit Solution

VuNet’s vuSmartMaps™, an award-wining AIOps and big data analytics platform helps CxO’s transform their enterprise IT Operations for the new age digital enterprise. It aims at aiding IT operations to make a shift from monitoring touch points to a service-oriented view.

In a first of its kind, vuSmartMaps™ brings together its platform enablers – Data pipeline for Unified Visibility, Correlation Engine for meaningful data, MLOps for ML Driven KPIs, and Integration for Automation to enable organizations reach IT operations maturity goals. A complete full stack AI/ML, big data platform, vuSmartMaps™ comes with over 500 pre-packaged domain specific adapters, powerful correlation algorithms, custom workflows add-on, advanced visual storyboards to contextual alerts, packaged to provide a valuable and enriching experience to customers.

To know more about vuSmartMaps™ and how it can transform your enterprise IT Operations, contact us.