Empowering Banks and Biller in the Bharat Connect Era with Business Observability

- Nov 7, 2025

- Blogs

- 6 min read

Over the last decade, India’s digital payments have transformed from cash-heavy transactions to one of the world’s most dynamic, convenient, and inclusive digital payment ecosystems. At the center of this transformation is the Bharat Connect System. Operated by NPCI, it is designed to make payments easy, secure, interoperable, and reliable for every consumer and biller.

The Reserve Bank of India (RBI) has recently mandated the use of Bharat Connect for all third-party credit card bill payments as a measure for standardization and interoperability.

Even though it’s optional for categories such as utilities, telecom, or insurance, banks and billers are choosing Bharat Connect as their preferred payment system. The reason is simple: it provides a uniform payment experience across bill types, instant confirmation, and greater reliability and trust in every transaction.

This growing adoption is both an opportunity and a challenge. Banks and billers can serve customers better, but they must ensure operational excellence at scale.

What is the Bharat Connect System?

Bharat Connect is a unified platform for paying utility bills such as electricity, gas, water, DTH, insurance, and loan EMIs.

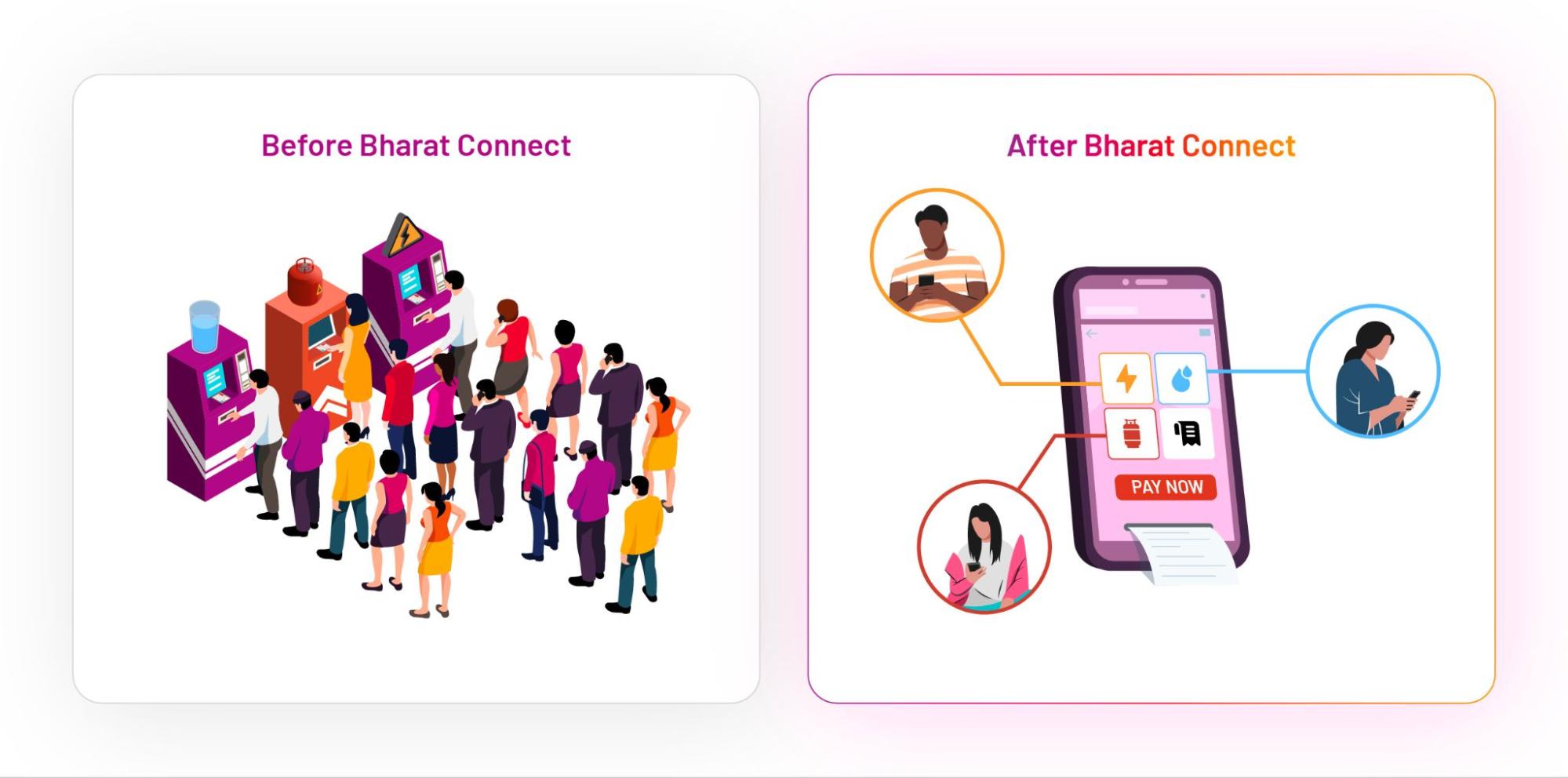

Earlier, customers had to navigate different websites, apps, or local counters, each with its own process and formats, leading to confusion and delays. On the other hand, billers managed separate integrations for different banks and channels, resulting in complexity and operational inefficiency. Additionally, the underlying systems also faced challenges such as fragmented payment touchpoints, delayed processing and reconciliation, limited access in rural areas, and concerns around reliability and security.

Fig 1: Bill payments before and after Bharat Connect

Bharat Connect was introduced to address these challenges. It ensures:

- Standardization: Simplifies payments with a single uniform process across multiple touchpoints, including bank branches, ATMs, mobile banking, internet banking, and agent outlets.

- Real-time Processing: Instant bill payments and confirmation, eliminating delays and uncertainty.

- Single Point Integration: Billers integrate once with Bharat Connect, not with multiple payment channels, reducing complexity and costs.

- Nationwide Reach: Coverage across urban, semi-urban, and rural areas through an extensive network of billers and operating units.

- Trust and Security: Operated by NPCI under RBI oversight, ensuring safety, transparency, and reliability.

What Bharat Connect Means for Banks and Billers

For banks, Bharat Connect enables them to extend payment services across digital and assisted channels, onboard new billers faster, and offer customers a unified experience across payment types.

For billers, it eliminates the complexity of managing multiple integrations and settlements with different partners. It offers wider reach, faster settlements, and higher customer confidence.

However, with the RBI’s oversight, the framework also demands traceability, accountability, and transparency. Banks and billers have to

Fig 2: Bharat Connect – Expectations from Banks and Billers

In such an interconnected ecosystem, even minor issues like delayed confirmations or mismatched records can cascade across the network, impacting both customer experience and regulatory compliance.

Why Observability Is the Missing Link in Bharat Connect

In a complex, high-volume ecosystem like Bharat Connect, observability is what keeps trust intact. It goes beyond traditional monitoring by providing contextual visibility—helping banks and billers understand how systems perform, why issues occur, and what impact they have on customers and compliance.

Observability enables:

- Trace every transaction end-to-end, across internal and partner systems.

- Detect anomalies, latency, and errors proactively before customer impact.

- Monitor business KPIs such as payment success rates and settlement performance.

- Accelerate root-cause analysis and incident resolution.

- Strengthen fraud detection and operational intelligence.

By embedding observability into their operations, banks and billers move from reactive troubleshooting to proactive assurance, ensuring resilience, performance, and trust in every transaction.

How Vunet Powers Bharat Connect with Business-centric Observability

VuNet’s Business-centric Observability Platform provides banks, billers, and operating units with unified visibility across their entire Bharat Connect ecosystem. Built for citizen-scale with no performance degradation, it connects technical telemetry with business insights, enabling teams to see not just what happened, but why it happened and what it means.

Key Capabilities:

- Full-Stack Monitoring: Complete visibility across infrastructure, applications, and business processes from a single platform

- Seamless Integration: Connects readily with existing Bharat Connect and third-party systems

- Real-Time Analytics: Instant insights into system performance, transaction flows, and business metrics, enabling proactive decision-making

- AI-Powered Intelligence: Machine learning based anomaly detection, predictive analytics, and automated root cause analysis

- Business Impact Monitoring: Tracks metrics such as transaction success rates, settlement times, and customer experience indicators

- Multi-Stakeholder Visibility: A unified view across banks, billers, payment providers, and network operators

- Regulatory Reporting: Automated generation of compliance reports and audit trails for RBI and NPCI oversight

Use Cases Where VuNet Adds Value

Use Case | Scenario | VuNet Solution | Business Impact |

Real-Time Transaction Monitoring | Monitor millions of bill payments across channels and billers |

| Reduced transaction failures, improved customer satisfaction, and faster issue resolution. |

Fraud Detection and Prevention | Identifying and preventing fraudulent activities |

| Reduced fraud losses, improved security, and enhanced regulatory compliance |

Settlement and Reconciliation Monitoring | Ensuring accurate and timely settlements between multiple parties |

| Reduced settlement disputes and operational efficiency |

Customer Experience Optimization | Enhancing customer experience across all touchpoints |

| Improved customer satisfaction scores and reduced support costs |

Regulatory Compliance and Reporting | Meeting RBI and NPCI compliance requirements |

| Reduced compliance costs, faster regulatory reporting, and minimized regulatory risks |

Infrastructure Performance Management | Optimizing technology infrastructure |

| Improved system reliability, reduced operational costs, and enhanced scalability |

Conclusion

The RBI’s mandate for credit card payments through Bharat Connect is just the beginning. As more bill categories join the network, the emphasis will shift from adoption to assurance—ensuring every payment is reliable, traceable, and compliant.

For banks and billers, the question is no longer how to participate, but how to perform with confidence.

VuNet’s Business Observability Platform gives them that confidence—transforming visibility into insight, and complexity into control.

Because in digital payments, trust isn’t built by technology alone—it’s built by observability.

Talk to us to know how VuNet makes digital payments seamless, secure, and business-driven.