Ensure Seamless Flow Of UPI Transactions

Track UPI payment end-to-end—detecting issues at each hop before they impact customers or damage your brand.

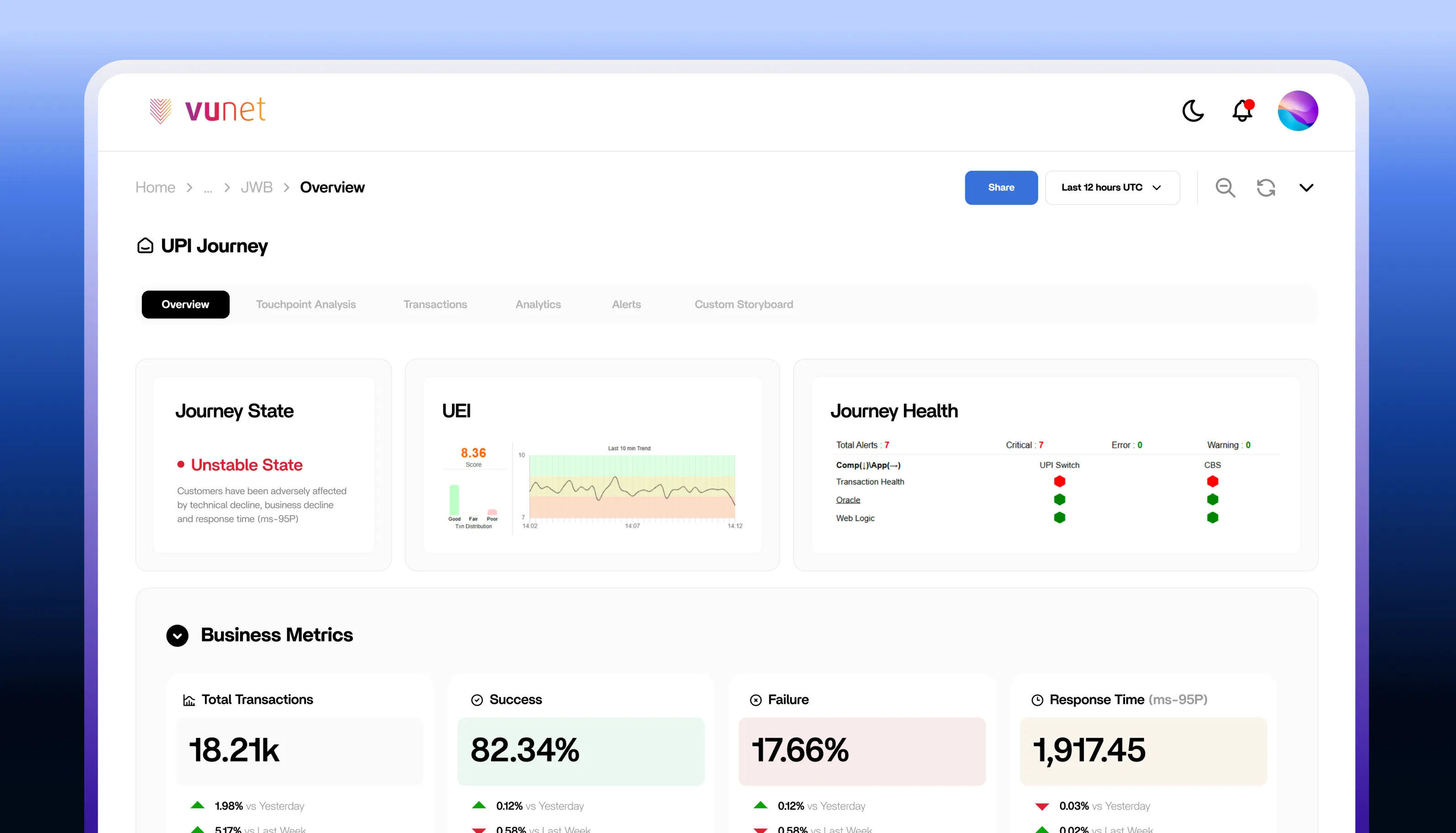

Delivers Visibility Across 28B+ Monthly Transactions

The Billion-Transaction Challenge

Citizen-Scale Volume, Zero Tolerance for Failure

Any latency or failure instantly impacts customer experience and erodes trust in the entire payment ecosystem.

Complex Multi-Stakeholder Ecosystem

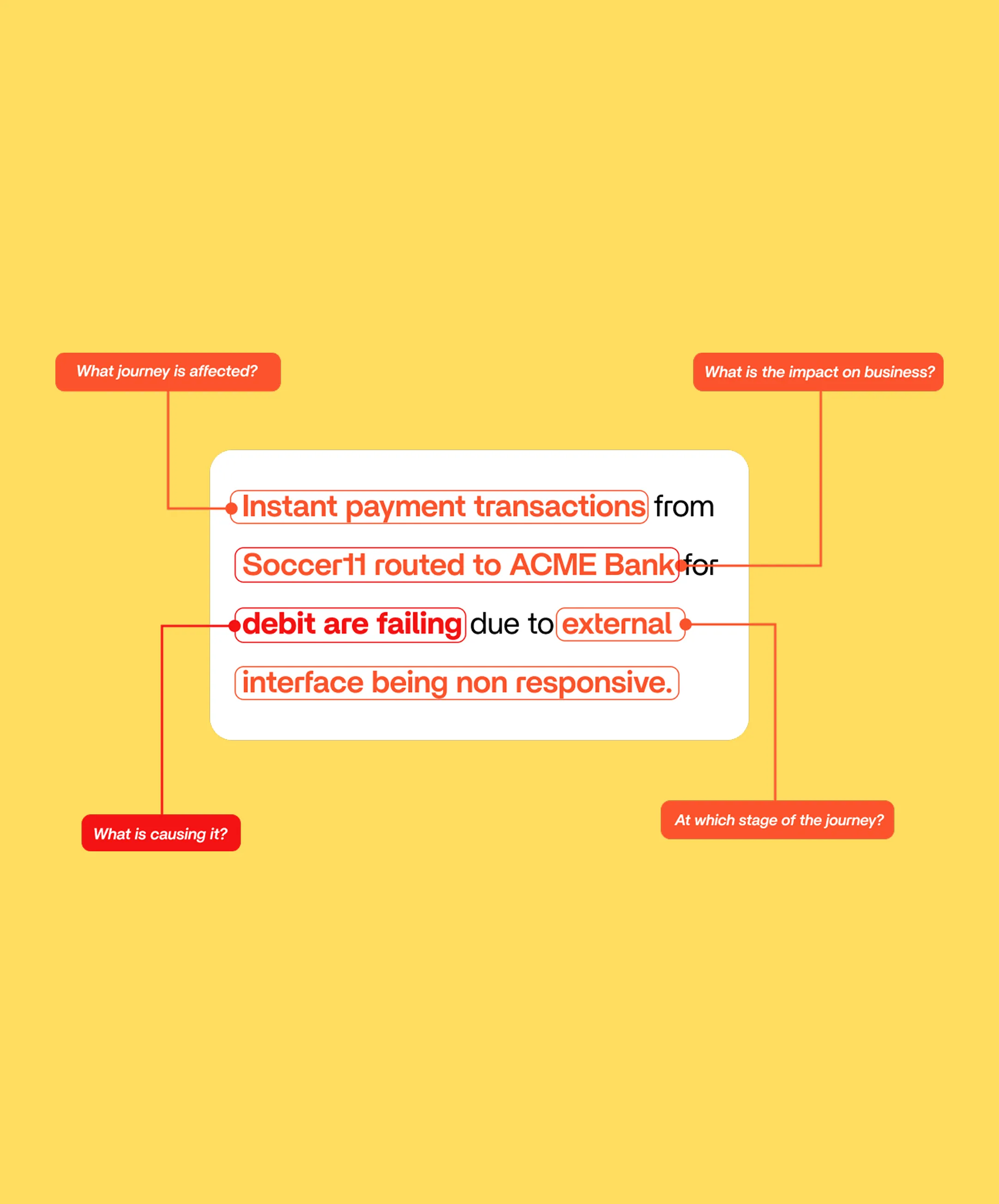

When payments fail, pinpointing whether it's your system, a partner bank, or network infrastructure becomes a guessing game across stakeholders.

Real-Time Means No Room for Error

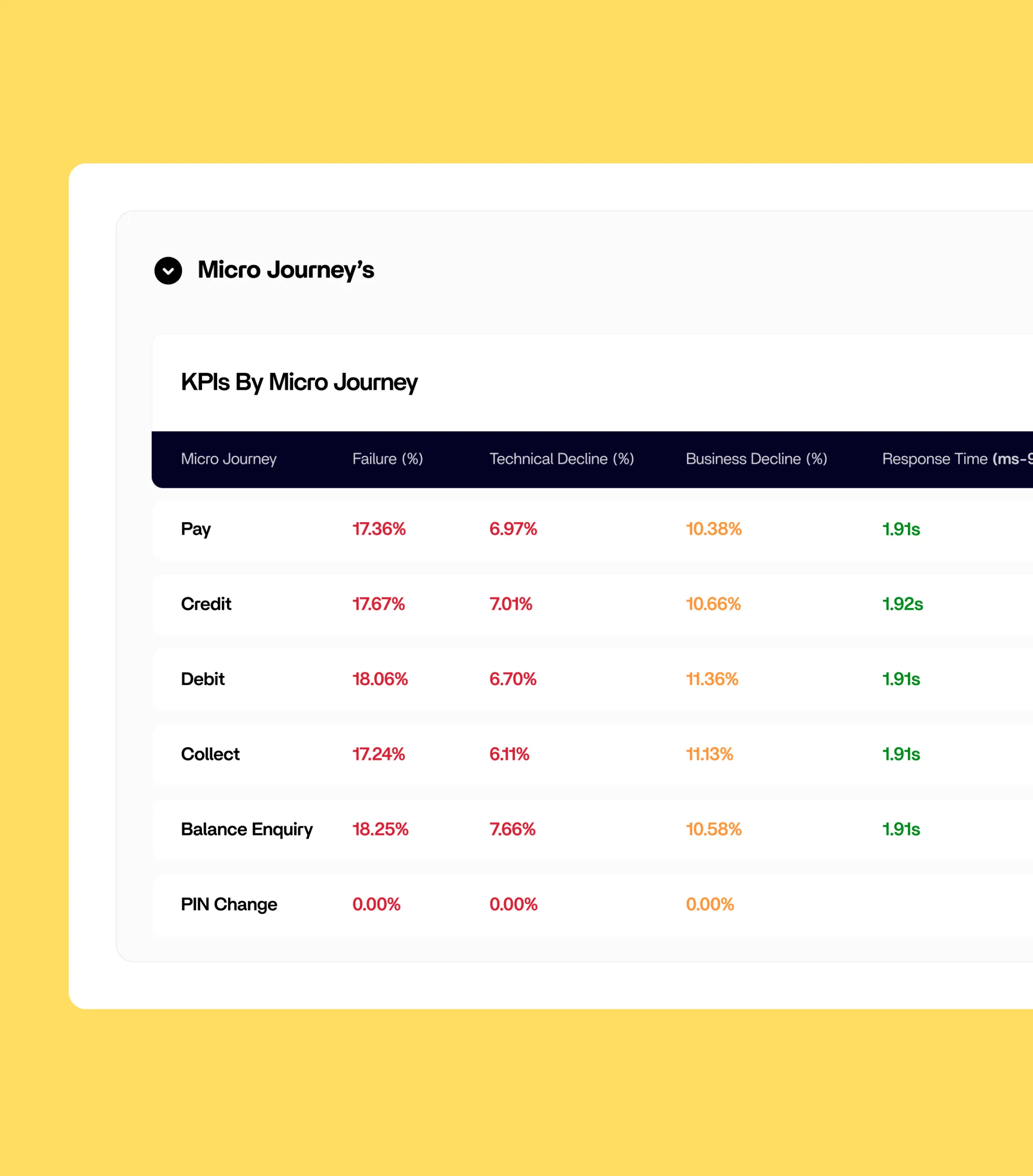

A 2-second delay feels like failure. Traditional monitoring shows system health but not which specific Pay, Collect, or Transfer transaction is stuck or why success rates are dropping.

Support Teams Operate Blind

Without transaction-level tracing, support teams can't quickly tell customers what happened or when issues will resolve.

End-to-End Visibility Across the Instant Payment Ecosystem

Complete Transaction Journey Tracking

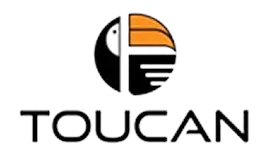

- Monitor every UPI transaction from initiation through settlement with real-time visibility into latency, error rates, throughput, and success rates across all hops—customer app, PSP, regulator switch, beneficiary bank.

- Trace individual transactions with hop-by-hop status, timing information, failure reasons, and resolution status to enable instant support resolution.

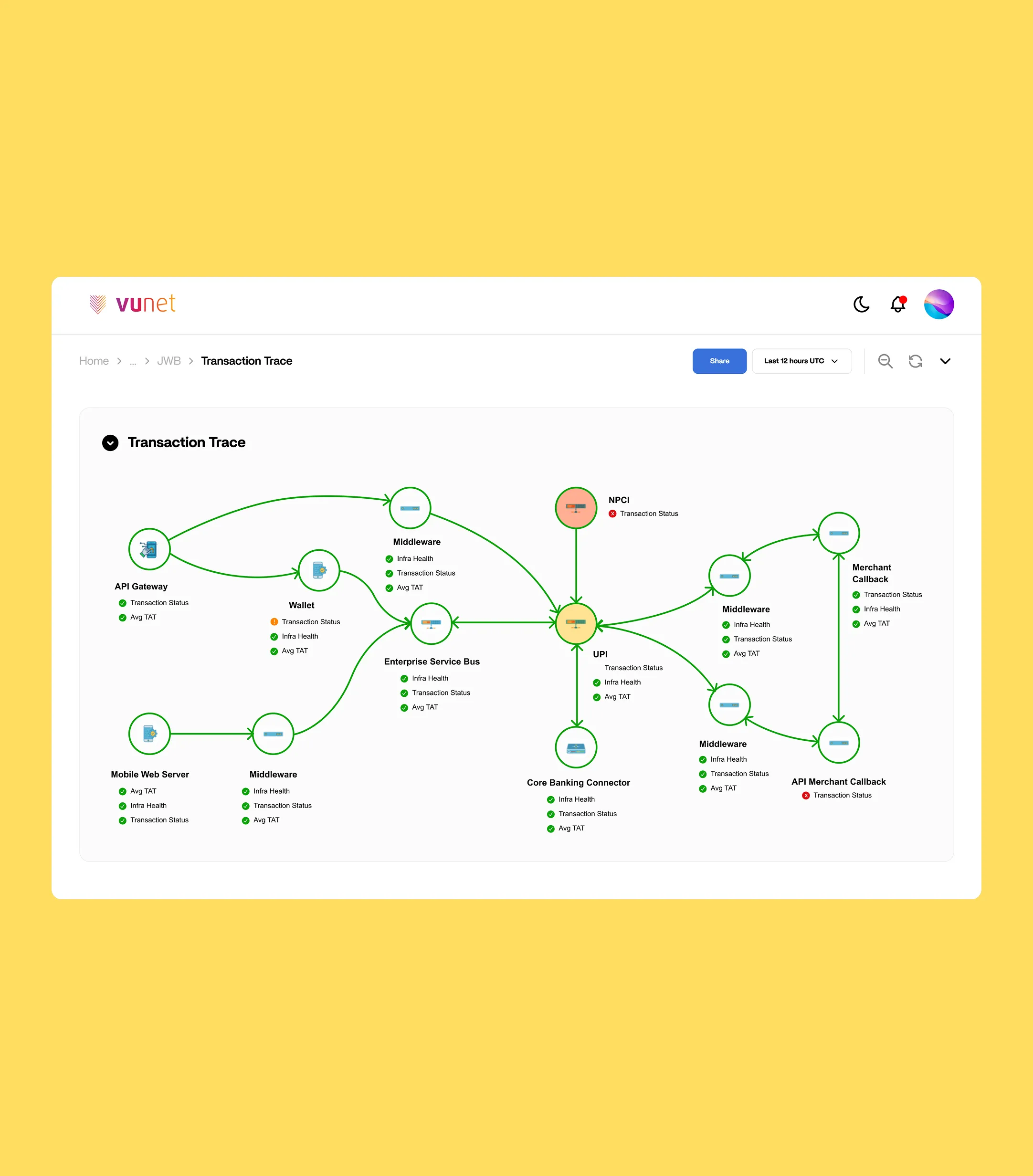

Micro-Journey Level Analytics

- Track every transaction type - from P2P and P2M payments to collect requests, credit/debit operations, and mandate workflows

- Monitor validation and authorization steps - QR scans, VPA verification, balance checks, and transaction authorization at each stage

- Measure action-level performance - see exactly where delays occur in registration, approval, or execution flows

Multi-Dimensional Performance Analytics

- Payer PSP performance: Track success rates and latency by originating payment service provider

- Payee PSP performance: Monitor receiving bank/PSP reliability and processing speed

- Geographic patterns: Identify regional issues, network problems, or infrastructure bottlenecks

- Time-based trends: Peak hour performance, daily patterns, seasonal variations

Ecosystem Dependency Monitoring

Track partner bank API performance, regulator switch response times, third-party app integration health, and network infrastructure status with aggregate KPIs and drill-down capability to individual failed transactions for root cause analysis.

Intelligent Business Impact Alerting

- Success rate drops below thresholds (overall or by PSP/bank)

- Latency spikes impacting user experience

- Partner bank or PSP connectivity issues

- Geographic outages or regional failures

- High-value transaction failures requiring immediate attention

Business Observability That Delivers Bottom-Line Results

Built For Always-On, Real-Time Payment Rails

Built For Payment Ecosystems

Pre-configured understanding of UPI flows with native support for NPCI mandates and multi-PSP environments.

Citizen-Scale Performance

Handle billions of transactions with real-time processing. Proven deployment monitoring 28B+ monthly transactions across India's payment infrastructure.

Seamless Integration

300+ adaptors to connect with infra components, alongside 30+ domain-centric adaptors that cover UPI, RuPay, lending, and more.

Business-Centric Intelligence

Correlate technical metrics with business impact—understand not just what failed, but which customers, merchants, and partners are affected.