Scene: Meera, Head of Technology at ABC Bank, meets Arjun, Head of Enterprise Architecture at a technology services firm, after an industry roundtable. Meera is leading the evaluation of a high-performance business observability solution for her bank.

Meera: Arjun, we’re evaluating observability platforms for our bank. It’s challenging to make a decision in a crowded market. Everyone claims they are the best. How and what should I focus on to make the right choice?

Arjun: Meera, start with ensuring the platform speaks both languages — business and IT. From a business perspective, the platform should be able to provide your specific domain/business context. For e.g.: Say your payment API is slowing down and it is delaying payment transactions or a failed batch job has delayed loan settlements. The platform should not just tell you what failed but also how it failed and, most importantly, tell you the impact the failure or delay has on customer experience and compliance. Essentially, it should give you complete visibility into the payment transaction journey.

From an IT perspective, it should address failures, downtime, transaction latency, errors/exceptions, and the underlying IT stack by correlating diverse data sources, including logs, traces, and metrics. It should have a solid ingestion mechanism, real-time correlation, and scale to handle citizen-scale transaction volumes.

And most importantly, the platform must tie both perspectives and provide a unified view for impactful decision-making.

Meera: That makes sense. Many tools claim “real-time,” but what does that actually mean at citizen-scale?

Arjun: It means no blind spots. The platform should stitch together events across synchronous and asynchronous transactions. Think of an IMPS transfer - initiated on mobile, validated via an API, settled in CBS (Core Banking System), acknowledged via SMS. If one leg is delayed, you need visibility across the chain.

A large NBFC stress-tested this by replaying GST filing data, ensuring ingestion without drop and correlation within seconds, which boosted their confidence.

Meera: And business leaders will ask — how does this translate into outcomes, not just IT efficiency?

Arjun: Outcomes come from business-contextual insights and AI-driven analytics. AI can surface fraud, anomalies, and customer journey risks before they become escalations. One large private bank identified that customers were churning due to technical declines. By reducing the technical declines to less than 0.5%, the bank could substantially reduce customer churn (impacting $100 million per year of transaction value). Another private bank detected and removed duplicate transactions resulting in an improvement in debit reversal success rate for instant payments from 73% to 83%.

Meera: What about flexibility — deployment, scalability, and integration? Our systems are sensitive to interference.

Arjun: That’s where design matters. Look for solutions with:

- Open standards like OpenTelemetry to avoid lock-in.

- Deployment flexibility — on-premise, hybrid, or cloud-native.

- Ease of integration — minimal intrusion into your core systems.

- Ability to read any kind of data — logs, traces, events, real-time user data, without requiring heavy rewrites.

Meera: And role-based usability? My teams span operations, risk, compliance, and IT.

Arjun: Exactly. The platform should allow role-based dashboards. Business leaders see revenue-at-risk, risk officers see compliance adherence, and IT sees system health. Custom dashboards, drill-downs, and contextual reporting should be easy to configure.

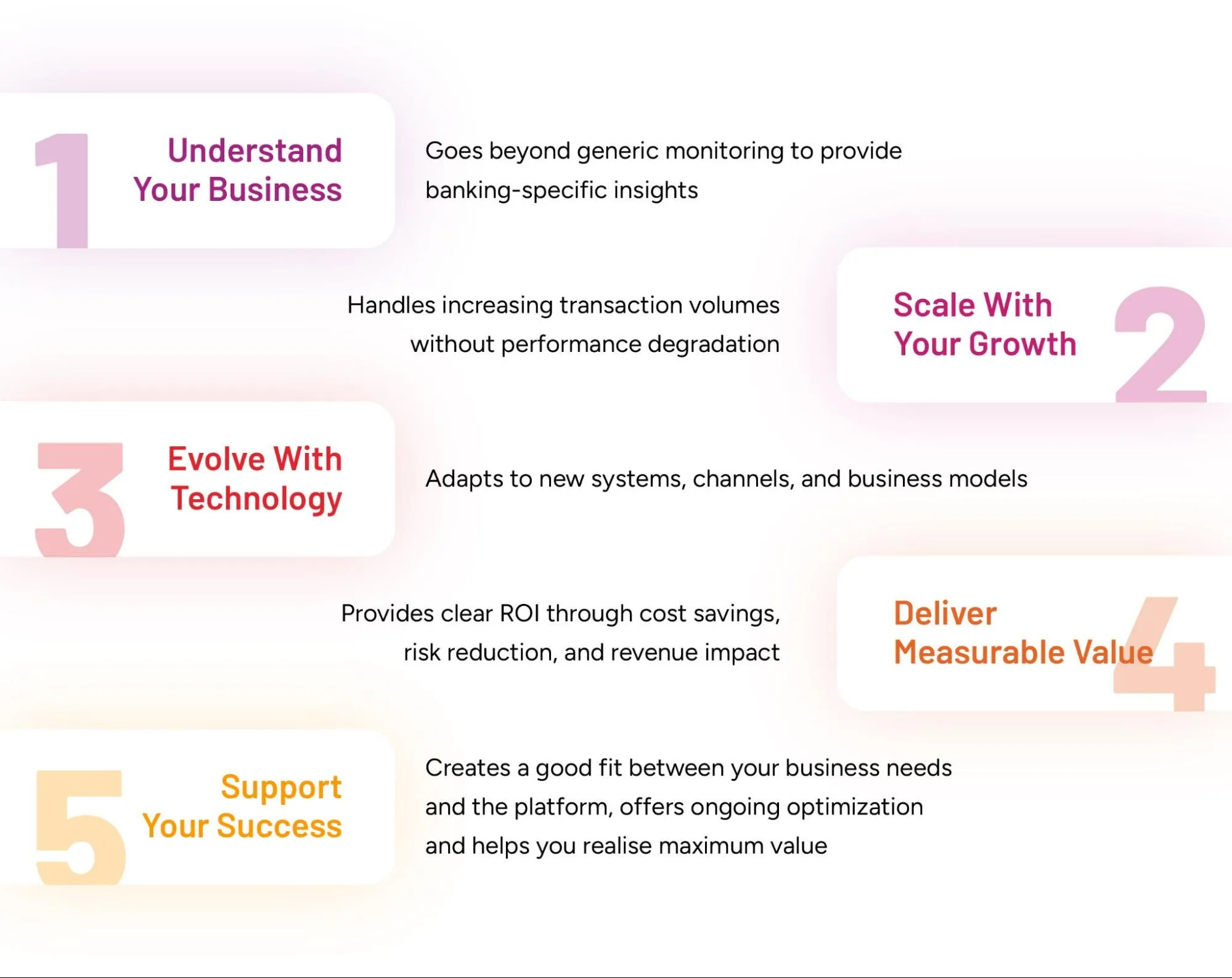

Meera: So, in summary, we need a platform that is both technically robust and business-aware. Can we outline the critical considerations clearly?

Arjun: Absolutely. Here is a checklist you can use.

Key Considerations When Selecting a High-Performance Business Observability Platform

Fig 1: Checklist for selecting the right Business Observability Platform

Meera: That’s a comprehensive checklist. If we use this as our evaluation framework, we can defend both the business case and the technical choice.

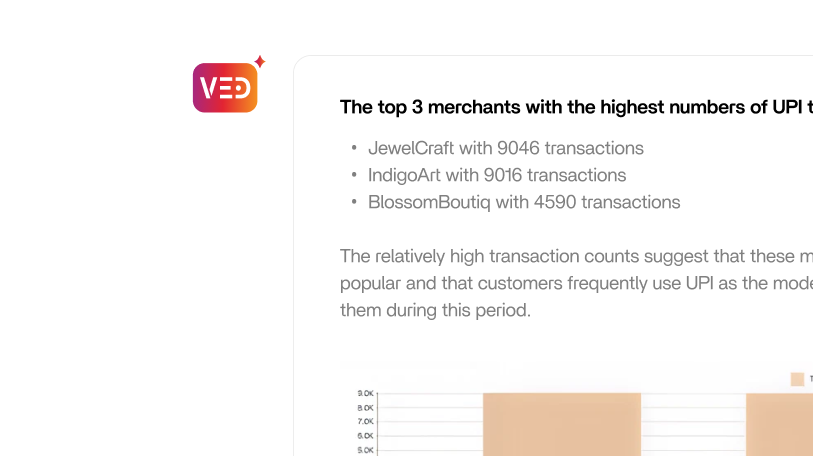

Arjun: Exactly. High-performance business observability is about context, scale, and insight. Get that right, and you not only justify the investment but future-proof it. And remember another thing. Selecting a business observability platform isn't just about comparing feature lists. It's about choosing a strategic partner that will:

Fig 2: Considerations for the right partner

Meera: Thanks, Arjun. I thought the crowded market made the selection of a tool tough. But it turns out to be simpler: Find the partner who unites business and IT.

Arjun: Exactly. You’re not picking a tool, you’re picking the right partner. Good Luck, Meera.

%201.webp)