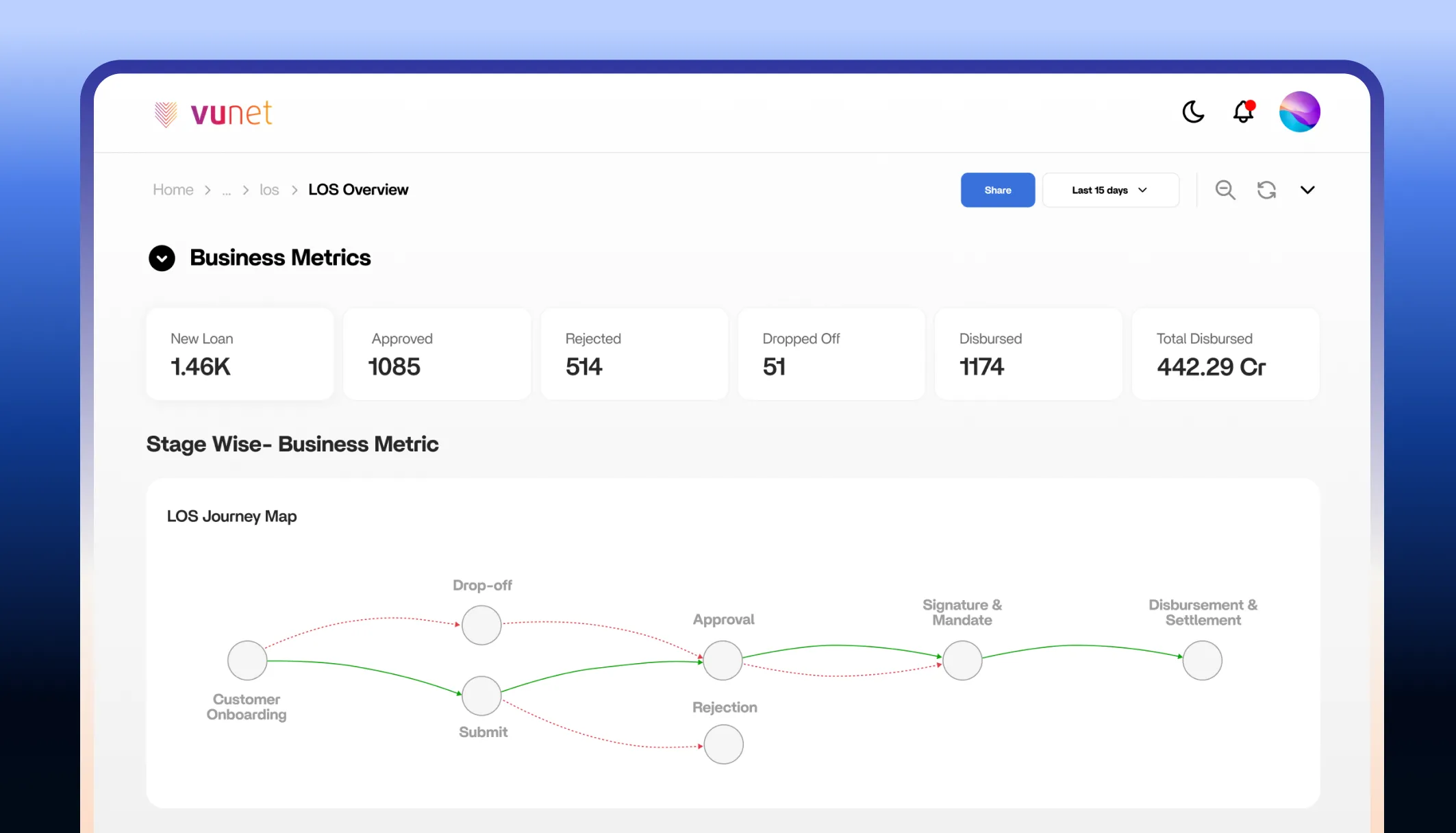

Real-time Visibility Across Your Entire Lending Workflows

Monitor credit decisioning, KYC verification, documentation processing, and multiple critical asynchronous flows to accelerate approvals while maintaining compliance and reducing drop-offs.

Delivers Visibility Across 28B+ Monthly Transactions

The Loan Processing Black Box

Complex Workflows, Invisible Bottlenecks

Loan applications touch multiple systems. When applications stall, you can't see where or why until customers call asking for updates.

Volume Without Visibility

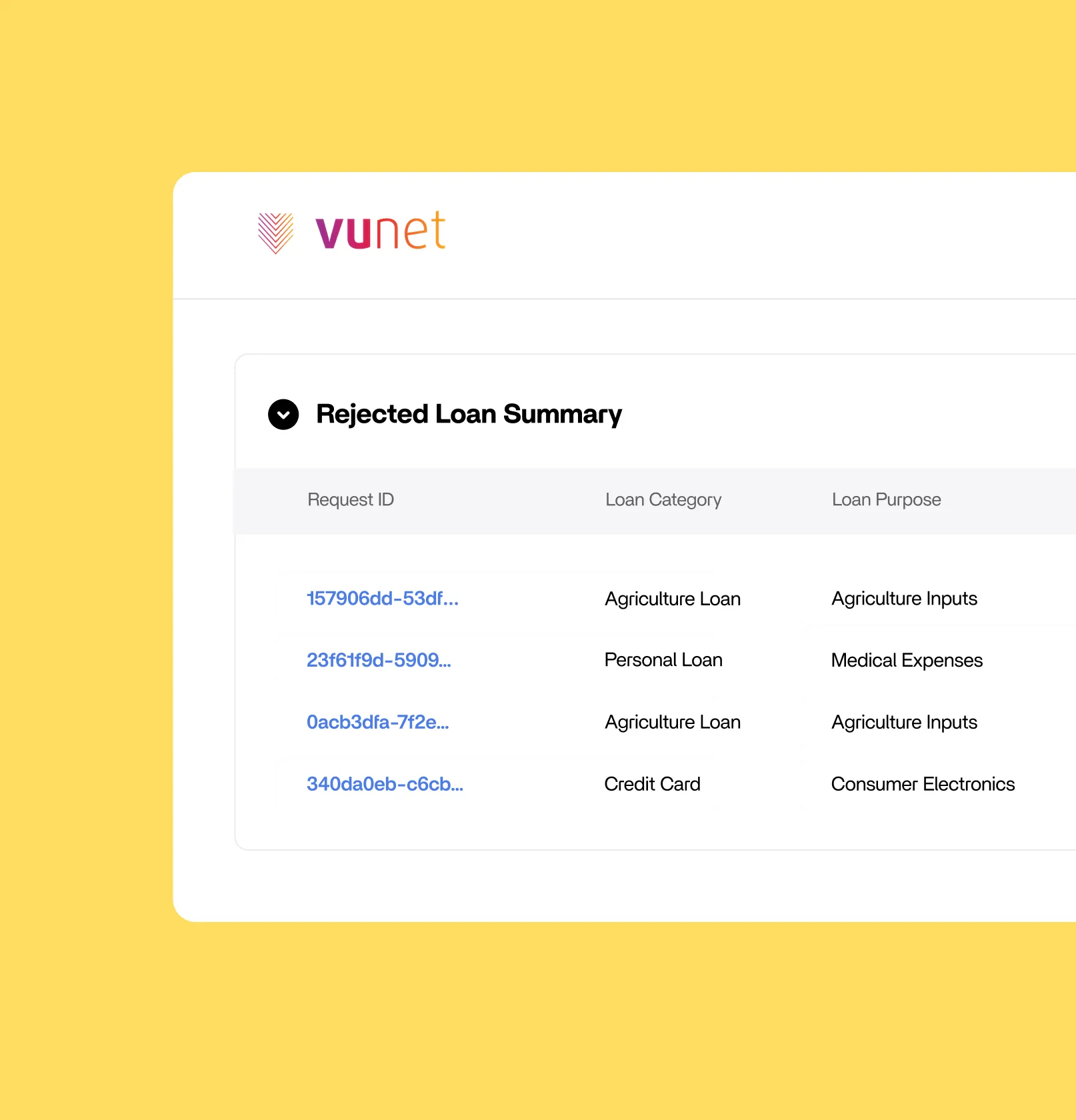

Traditional monitoring shows system health but not which high-value applications are stuck in underwriting or why approval rates are dropping.

Compliance Creates Friction

Regulatory requirements add verification steps at every stage of the approval process. Manual tracking makes it impossible to prove compliance during audits.

Asynchronous Processes Create Blind Spots

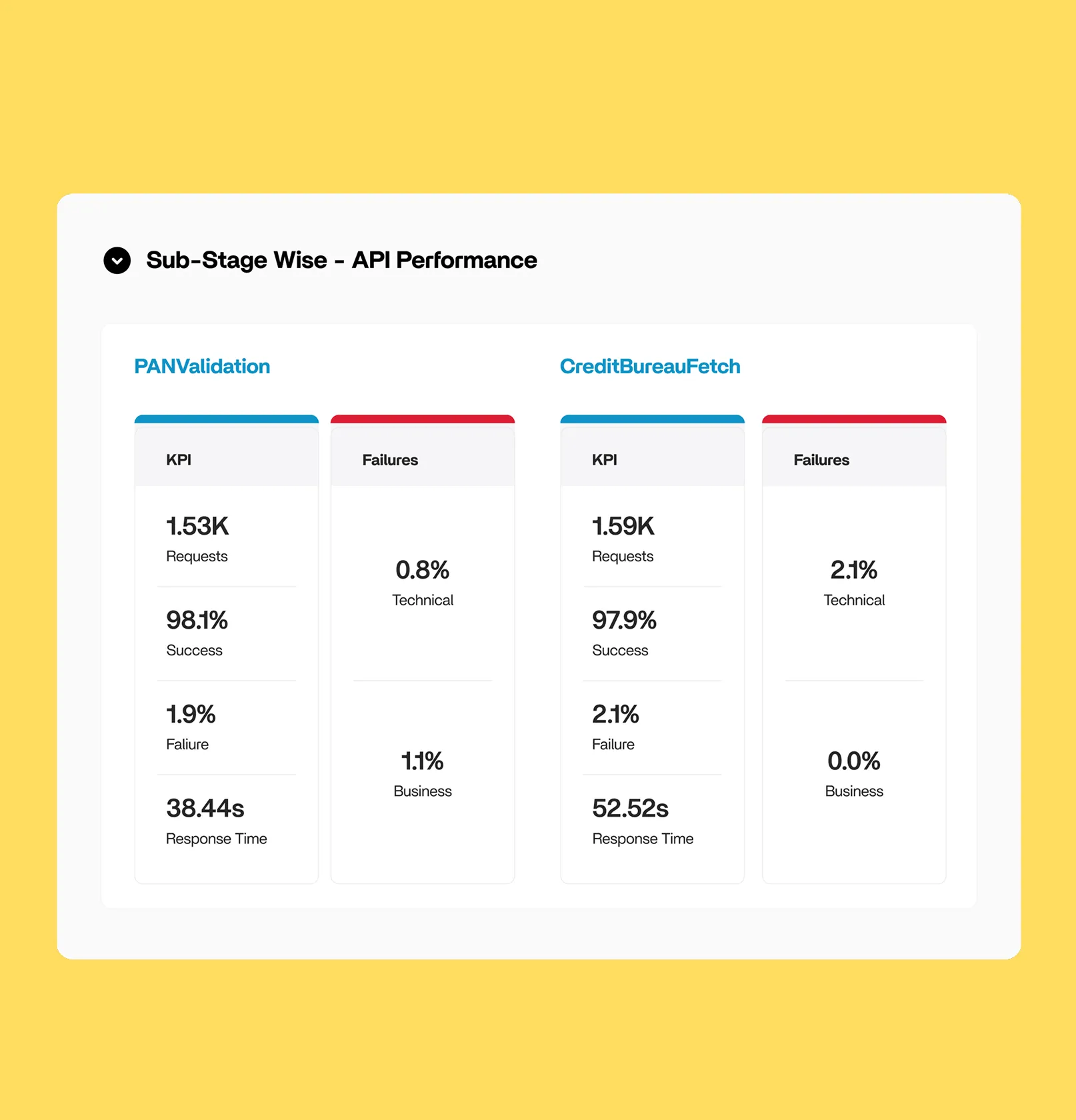

Credit checks, document verifications, and background screenings happen async with different TATs. Traditional APM distributed tracing can't connect these dots.

Complete Observability for Modern Lending Operations

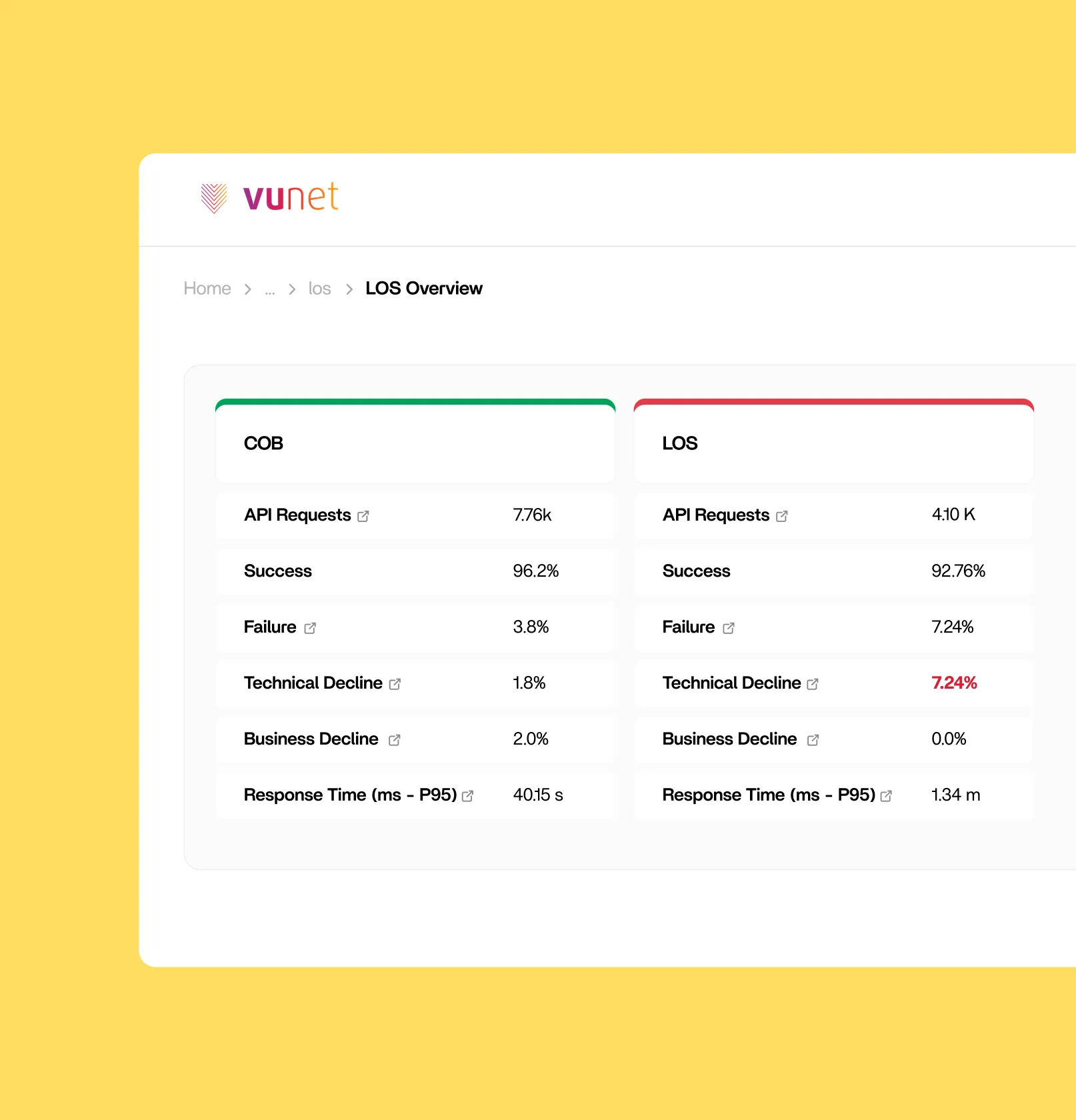

Application-to-Disbursement Journey Tracking

- Follow every loan application through its complete lifecycle, including synchronous and asynchronous flows; with telemetry captured from your Loan Origination System (LOS) alongside all integrated systems.

- Link process failures and degradation back to the corresponding APIs and IT systems, enabling you to quickly isolate which APIs, microservices, or components are contributing to bottlenecks or failures.

Track Loan Product-Specific Workflows

- Personal Loans: Instant credit scoring, income verification, rapid approval workflows

- Mortgages: Property valuation, legal checks, multi-stage approvals, extended documentation

- Auto Loans: Dealer integration, vehicle verification, fast-track processing

- Business Loans: Financial statement analysis, collateral assessment, multi-party approvals

Credit Decisioning Transparency

- Track interactions with credit bureaus, scoring models, and risk assessment engines.

- Understand decision timelines, API latencies, and approval/rejection patterns across customer segments.

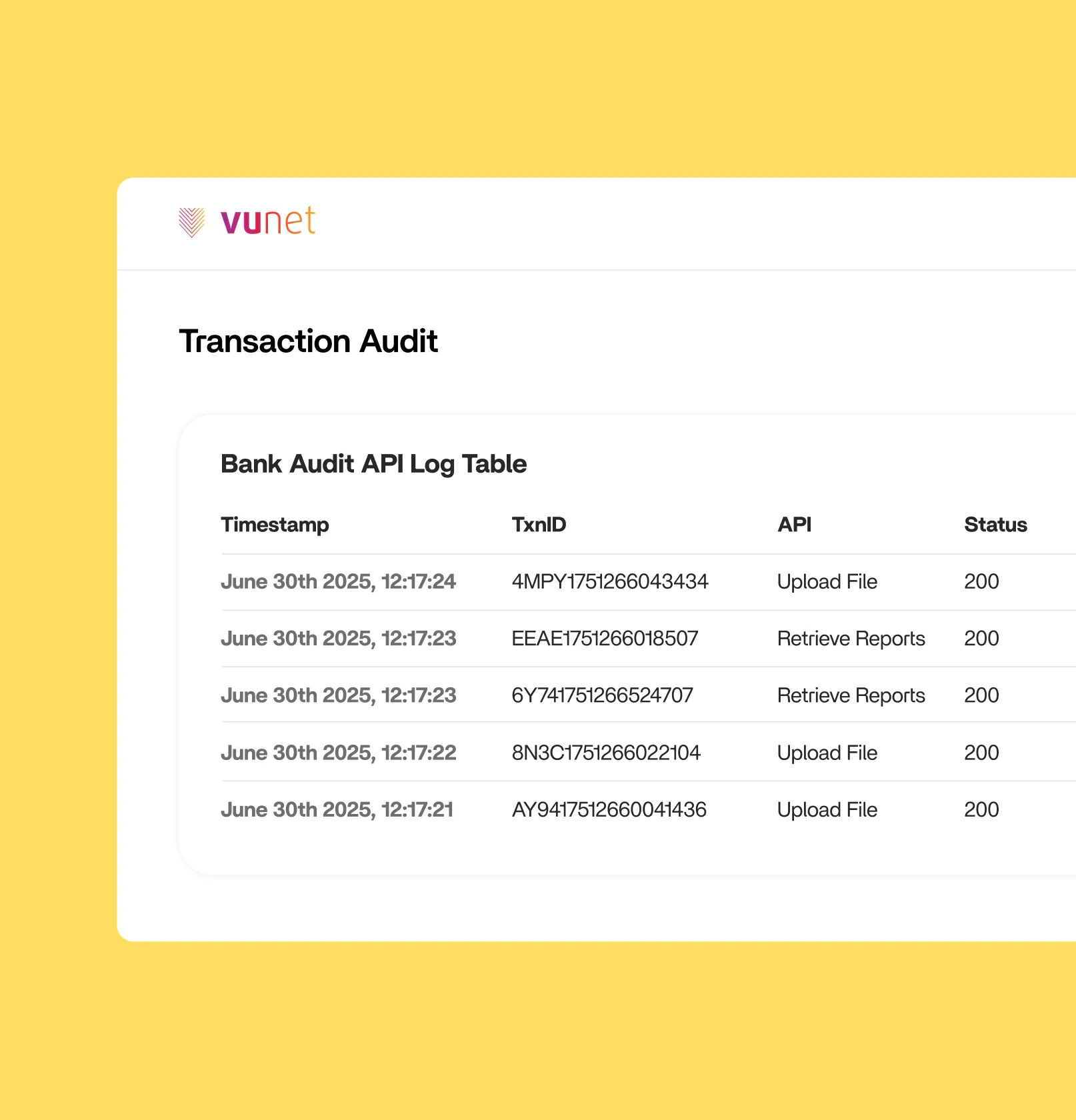

KYC and Compliance Monitoring

- Document upload and OCR processing success rates

- Third-party verification API performance (Aadhaar, PAN, bank statements)

- Regulatory requirement completion status

- Audit trail generation and retention

AI-Powered Process Intelligence

Machine learning identifies patterns in successful vs. abandoned applications. Predict which applications are at risk of drop-off and recommend interventions to improve conversion rates.

Business Observability That Delivers Bottom-Line Results

Built For High-Volume, High-Velocity Lending Journeys

Purpose-Built for Lending Workflows

Pre-configured understanding of loan origination, underwriting, and disbursement processes. Native support for lending platforms and credit bureau integrations.

Seamless Integration

300+ adaptors connect to loan origination systems, credit bureaus and payment gateways without touching existing code or workflows.

Scale for Digital Lending

Handle thousands of concurrent applications with 10X faster data processing. Built to support the transaction volumes that digital lending generates.

Compliance-First Design

Automatic audit trail generation, regulatory reporting capabilities, and data retention policies that meet financial services requirements.